Contents

- Introduction to Small-cap mutual funds

- Eligibility for Small-cap mutual funds

- Working on Small- cap Mutual funds

- Why invest in Small Cap- mutual funds?

- Merits of Small-Cap mutual funds

- How to Invest in Small-cap Equity Funds?

- Step 1

- Step 2

- Step 3

- Step 4

- Step 5

- Evaluation points of small-cap mutual funds

- Standard Deviation

- Sharpe Ratio

- R-Square

- Alpha

- How one can select the best small-cap funds?

- Quantitative Parameters:

- Performance and risk analysis

- Performance across market cycles

- Qualitative Parameters:

- Portfolio Feature:

- Quality of Fund Management

- Demerits of Small-cap mutual funds

- Points to be noted while investing in it

- Tax benefits in Small-cap mutual funds

- The way to reduce risk when investing in small-cap mutual funds

- 10 best performing Small-cap mutual funds

- Conclusion

Small Cap Fund is a kind of equity mutual fund. That invests most of its assets in the stocks of small-cap companies. These are the companies that rank 251st and higher in terms of market capitalisation. Approximately 95% of all Indian classified companies are small cap companies. Sebi protects the interest of investors in small-cap mutual funds

Introduction to Small-cap mutual funds

The size of the company is an essential criterion when picking equity portfolios. This is because, on the basis of the size of the company, the portfolio would have its individual set of plans risks and opportunities.

Mutual Funds investments in terms of small-cap funds mainly in stocks of small companies that have the potential for development. These stock can increase or grow in a short measure of time. But this also indicates that the return from these funds is directed to great volatility.

The purpose of equity strategy will be to predominantly create a portfolio of small-cap companies which have:

a) Consistent Increase prospects

b) measure financial strength

c) Sustainable business models

d) The acceptable cost that gives the potential for capital recognition.

Read About: Best equity mutual funds

small cap mutual funds

Eligibility for Small-cap mutual funds

Small-cap funds are known for their great return potential. While market highs, these funds have a higher possibility of beating the benchmark. Though, when the market begins the fall phase, then the fund NAV all in aspects may differ considerably.

- If one is a risk seeker and need to increase their portfolio returns, then one must try these funds. Invest a little portion of the portfolio in small-cap funds for long-term wealth growth.

- While an investor, if he/she does not oppose to take huge or moderate risks, they can think to invest in other funds. Basically, that investor who wants short period funds can invest in this type of funds.

- The investor who has the capacity of higher risks can view investing in this category.

- One must have a small piece allocated in his/her portfolio in small-cap funds.

- When an investor is creating a stock portfolio for them, it is essential to have a benchmark upon which one can compare their returns.

The best approach to decrease risk can be investing through a SIP.

Working on Small- cap Mutual funds

- The cap in -small-cap stocks relates to a company’s capitalization as defined by the sum of the market value of its publicly traded shares. Small-cap stocks are normally portrayed as the stock of publicly traded companies. That has a market capitalization varying lower than ₹500 crores.

- Technically talking as underlying companies are blooming and attempt to extend aggressively. They are extra volatile and vulnerable to losses while downtime in the market.

- In a Small-Cap fund, the fund manager can have displayed to stocks of small companies in the scope of 65-90%.

- Small-cap stocks provide individual investors with an advantage across institutional investors. This is because institutional investors favour buying large-cap stocks due to its durability. While Investors wishing for aggressive returns will invest in these funds.

- Moreover, fund structure performs a vital role and an automatic decision will threaten one’s returns. It makes sense to invest in multiple funds, so one has a different choice of small and mid-cap funds in their portfolio.

Why invest in Small Cap- mutual funds?

The reason to invest in a small-cap mutual fund are :

- One can take steps to assure that investor can maximise wealth from their small-cap schemes.

- They can invest in them with a greater investment range of a point of 7- 10 years.

- An aggressive investor with a capacity to catch huge risk and withstand high volatility. They must consider investing in small-cap schemes with a higher investment horizon.

- With a long-term investment horizon seeming to tap into possibilities given by a small cap.

- The motive to capture the opportunities provided by small-cap space.

There are more enough reasons to invest in Small-cap mutual funds. Look at its merits that will help one to know how beneficial they are.

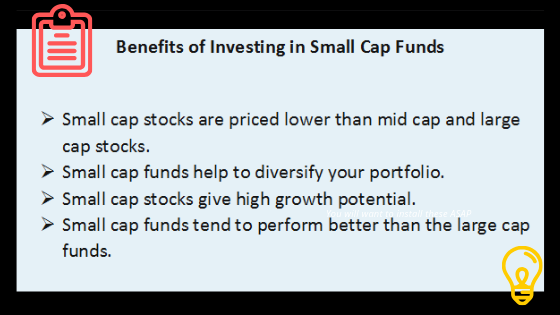

Merits of Small-Cap mutual funds

- Small cap fund has exponential extension capacity.

- They provide great returns on investment if right stocks are selected from a small cap section.

- Small cap stocks provide a big room for diversification in the fund’s portfolio.

- Will set a high value on the fundamental strengths of the company and the underlying business.

- They are underfollowed in the stock market and usually untapped by institutional investors, providing a large opportunity to smart investors to develop their investment immediately.

How to Invest in Small-cap Equity Funds?

Investing in Small-cap mutual funds can be done easily accessible at WealthBucket.

Explore these simple steps and Start an investment journey with a good amount of investment:

Step 1

Login in into the website –Wealthbucket.in

Step 2

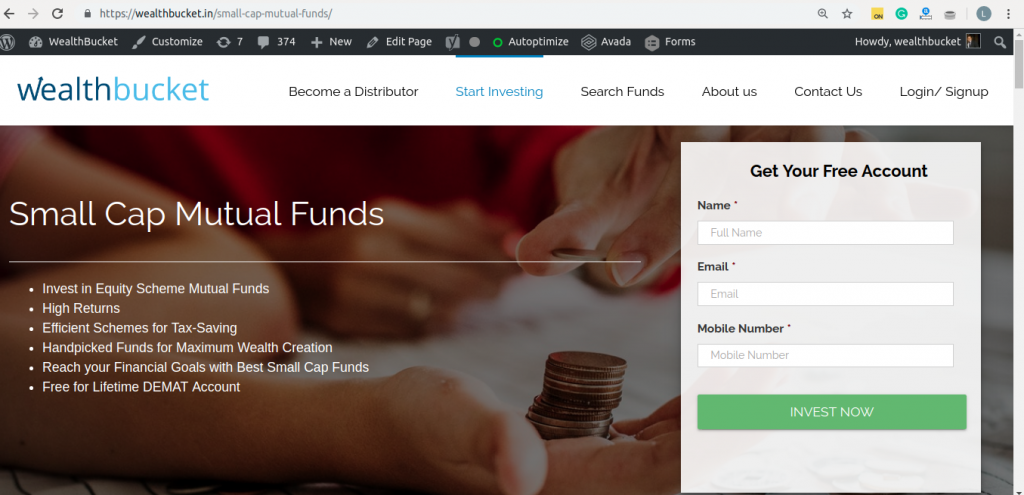

After login into the website. Go to Start Investing ( at the right side )there is an option for Small-cap mutual funds. Click on that.

Step 3

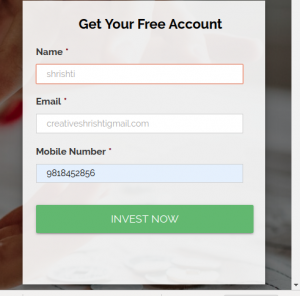

The page will display in the rightmost side “get you to account“. Enter all the details asked. and click on “invest now”.

Small cap funds

Step 4

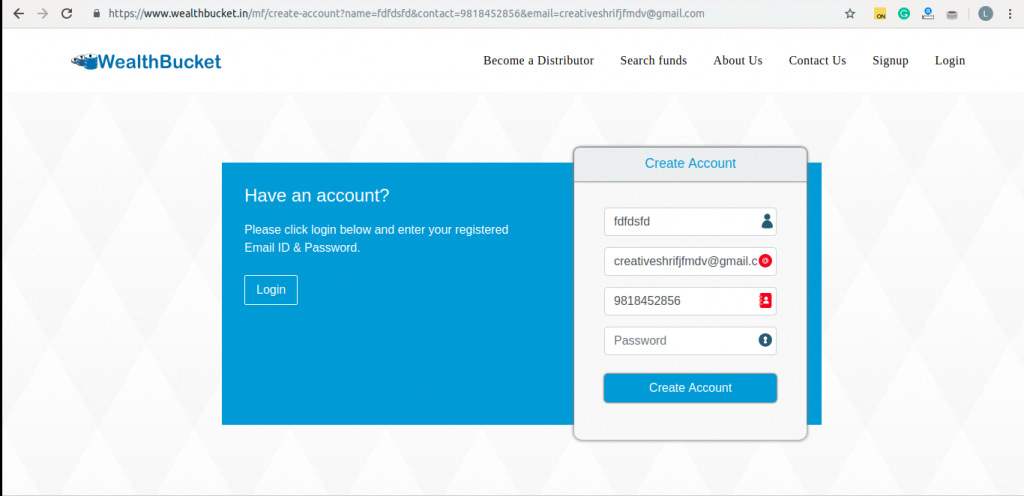

Then create an account and password. Plus, get your KYC done in 5 minutes by mentioning PAN number.

Step 5

Invest in chosen Small-cap mutual funds at Wealthbucket amongst hand-picked mutual funds.

Read about: Know your PAN

Evaluation points of small-cap mutual funds

The evaluation of small-cap mutual funds depends on some financial ratio. Some of them are :

Standard Deviation

In financial terms, the standard deviation indicates the annual rate of return on any investment. Plus the highlights the levity of the investment. A stock with a higher standard deviation has a larger cost range and indicates greater volatility as contrasted to a stock with a less standard deviation.

Sharpe Ratio

This ratio includes the risk-adjusted return of a portfolio. A financial portfolio that has a greater Sharpe ratio is seen as a comparatively higher portfolio as contrasted to its other funds.

SR = (AFR – RFR)/ SD

Note: SR =Sharpe Ratio

AFR =Average Fund return

RFR=Risk-free Rate

SD =Standard deviation of the fund returns

R-Square

R-Square gives the percentage of fund returns that are in series with the benchmark returns. The use of R-Square lies within 0 & 1. It is considered as percentages from 0 – 100%. If a fund has an R-Square of 100% it means that its securities’ movements are described by the movements in the index.

Alpha

It is a measure of an asset manager’s capacity to make a profit when a point is more enrolling a profit. Alpha can be either smaller than, similar to or more than 1.0. The larger this number, higher is the capacity of the manager to earn profits from the changes in the benchmark.

How one can select the best small-cap funds?

Quantitative Parameters:

Performance and risk analysis

This is to examine if the fund has display flexibility in performance over multiple market periods with average risk-adjusted returns.

In this, one requires to rank the fund basis of quantitative parameters like operating returns over the short-term and long-term duration. Like a 1, 3 and 5-year time duration. Sharpe Ratio, Sortino Ratio, and Standard Deviation across a 3-year duration are on the risk-reward ratios.

Performance across market cycles

One requires to assure that the small-cap fund has the capacity to work consistently over multiple market cycles. Hence, analyse the performance of all the possible small-cap funds in relation to their benchmark index over bull phases and bear market phases.

In case a fund has continuously generated greater returns-over time duration. Market cycles -bull and bear and suitably paid on the risk-return basis, shortlist these funds.

Qualitative Parameters:

Portfolio Feature:

It is vital for a small-cap mutual fund to hold a portfolio of featuring small-cap companies understanding their fundamentals. Moreover, it is necessary to focus notice to the following:

Sufficient Diversification -The scheme should not operate an extremely strong portfolio of preferred stocks. The portfolio must be well-diversified and the exposure to the best-10 holdings should be preferably under 50%. Estimating this decreases the risk that gets along with a strong portfolio.

- Low Churn -Retaining high churning can succeed in buying plus selling and large turnover cost. Hence, one also requires to analyse the portfolio turnover ratio, expense ratio and castigate funds including a very-high churning.

Quality of Fund Management

One also requires to refer to the fund manager’s experience, their over tasks and the stability of the fund house. The fund manager’s work experience plus a number of schemes managed by him. The performance of the fund house in handling one’s money.

Demerits of Small-cap mutual funds

- Small-cap funds are extremely risky and active investment instruments as contrasted to large and multi-cap fund level due to their exposure in great performing equities.

- These funds are not for all investors. Small-cap funds are strongly fit for investors with high-risk appetite or to seasoned investors.

- It is difficult to obtain dividends with small-cap funds by a lot of small-cap companies must pay a dividend.

- Duration of trading these funds i.e. buying and selling of these funds are very critical.

Points to be noted while investing in it

- The structure of the portfolio of small-cap funds and companies

- Analyse and review the past performance of the small-cap fund.

- Keep a Check the Price-earning Ratio.

- The Selection of a qualitative and effective fund house. That has a great ex[osure and development in many years.

- The returns need to be risk-adjusted.

- Take the advice and information from an experienced fund manager.

- One must know their options the risk and reward taking capacity is all in hands of the investor.

Tax benefits in Small-cap mutual funds

- The smallcap funds to benefit from tax breaks for small firms. Smaller companies are continuing to benefit from the corporate tax cut introduced in the budget.

- The tax break is working to enhance the PAT (Profit After Tax) of small companies. There is a chance that when the profits of these small companies go up, the stock prices might go up.

- If one needs to benefit from the tax, they should choose a mutual fund scheme that finances in smaller companies with or under Rs 50 crore turnover.

- The reduction in tax rate is limited to companies with a turnover of Rs 50 crore. There would be very fewer companies that would certainly fit for being in the investment because of the small size.

Read more: tax saving mutual funds

The way to reduce risk when investing in small-cap mutual funds

- Spend time examining small-cap funds. Funds with a certified record of up to 5 years are great.

- Expand the portfolio so that losses are minimum when the markets are below. A good mix of investments will serve as a shield upon a huge loss. One may also get great returns in different areas of investment when small-cap mutual funds fail to fulfil profits.

- Avoid attempting to time the market, as it is risky and unstable.

- Divining the market is very tough. If one goes wrong in their predictions, it could head to losses.

- Invest in small-cap mutual funds through the best SIP plans. It will average out the price, hence decreasing volatility.

Must read: Best Sip

10 best performing Small-cap mutual funds

Knowing all the measures in small-cap mutual funds no lets us discuss the best performing small-cap schemes and companies. The data provided below shows an of 31st May 2019. The mentioned below table helps one to understand the scheme names with companies mentioned. Also, provides the return plan in2,3 and 4 years.

| Scheme Names | 2 year | 3 year | 5 year |

|---|---|---|---|

| Axis Small Cap Fund – Growth | 9.45% | 13.40% | 16.71% |

| HDFC Small Cap Fund-Direct Plan – Growth | 12.18% | 19.66% | 18.88% |

| Reliance Small Cap Fund-Direct Plan – Growth | 7.28% | 17.95% | 21.32% |

| L&T Emerging Businesses Fund-Direct Plan – Growth | 3.28% | 18.56% | 18.50% |

| HSBC Small Cap Equity Fund – Growth | 8.06% | 13.19% | 12.29% |

| Aditya Birla Sun Life Small-cap Fund-Regular Plan | 9.92% | 15.02% | 16.38% |

| Union Small Cap Fund-Direct Plan – Growth | 5.73% | – | – |

| Franklin India Smaller Companies Fund – Direct – Growth | 2.38% | 10.89% | 17.83% |

| Kotak Small Cap Fund-Direct Plan – Growth | 1.37% | 11.18% | 16.83% |

| ICICI Prudential Smallcap Fund-Direct Plan – Growth | 2.02% | 11.70% | 11.17% |

Read more about : Kotak mutual fund

Conclusion

Small Cap firms are the companies which are listed as small-cap companies by SEBI or AMFI. At present Small Cap mutual funds, the 251 company onwards are in terms of complete market capitalization.

Do invest in small-cap mutual funds their benefits are numerous and will provide investors with a high amount of returns. Visit our website WealthBucket now.

You can also take help and suggestions from our experts for gaining through investments in equity fund investment, Debt mutual fund, Income Fund, Large Cap mutual fund or Multi-Cap mutual fund.

Call us at+91 9999379929. Or email at contact@wealthbucket.in

Read about:

What are the best Aditya birla mutual fund schemes