Contents

Meaning of liquid funds

Liquid funds (LF) are debt mutual funds. That invest investors money in very short-term market instruments and financial instruments. The instruments are :

- Bank fixed deposits

- Treasury Bills

- Government securities

- Call money

- Commercial Paper

- Certificate of Deposits

- Term Deposits

Call money includes the shortest amount of risk. Up to maturity of 91 days, these funds can invest in instruments. The maturity is frequently very lower than that. Liquid funds are mutual fund investments which have no limitations of a lock-in period. Debt mutual funds Net Asset Value (NAV) is calculated for business days only. Usually, the NAV of the funds is calculated for 365 days. Liquid mutual funds have a moderate interest in risk linked with all the class of debt funds. This reason is they essentially invest in fixed income securities with a short maturity. Also, they do not have any exit or entry load.

Sebi may also make it compulsory for liquid funds to consider the market the value of every bond that has a maturity of 30 days or extended.

One should know- Liquid Funds

Read more about: The process of investing in mutual funds

Eligibility

Who Should Invest In Liquid Funds?

- LF s are satisfying for risk opposed investors. In opinion, the higher the tenure of the paper, the greater is the influence of change in the interest rate. This fund invites investors who want to deposit their money for a very small time duration. Also, seek the security of funds.

- If Investors are targeting any short-term goals- then deposit the amount into LF. Get genuine inflation-adjusted returns on them. Short-term means a duration of less than 1 year.

Short term goals can be buying furniture or a family vacation and many more.SIP in LF is the brightest plan to target for these short-term goals.

For example, you are planning to buy furniture at the year end, then you can begin with a monthly SIP investment and slowly grow your shopping corpus. One can cater to SIP Calculator for knowing the amount at regular intervals. - One can opt for LF to mark a part of the emergency fund. These funds invest in capital market instruments. They fit also for a short-term investment range of fewer than 90 days. As maximum liquid mutual funds do not have any exit load. One can leave any time without any penalty.

- LF serves great for investors who are viewing for diversification of their entire portfolio. If one needs short term funds of say 3 months, then LF is reliable to pick up. They prove to be profitable as they produce greater returns as in contrast to a bank savings account.

Learn more about: How to Invest in SIP

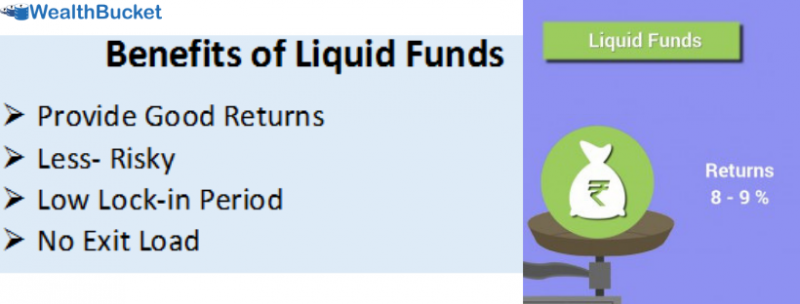

Benefits of Liquid mutual fund

- Liquid funds have the least level of risk. They are the least active between every type of debt mutual funds. The reason is their very short maturity period.

- The point is simple these funds often invest in instruments with great credit ratings.

- Liquid funds give unmatched liquidity to investors as the money continues invested for such a small duration of time.

- These funds allow investors to redeem their investments at any time.

- On redemption, one returns from liquid funds are credited to account in 1-2 days.

- Some liquid funds give the ability of instant redemption. This means that on putting a redemption order online. One quickly gets the rewards in your bank account.

Time to invest in liquid funds

Before investing in a liquid mutual fund it is important to know the result of shifting interest rates. Bond value and interest rates have the opposite relationship. Thus, when interest rates in the economy shift to upwards, values of bonds allotted at the rate less than the current rate move downward and vice versa.

Let’s view at liquid funds following the light of growing and dropping interest rate situations:

- Raising Interest Rate Scenario

In an increasing interest rate situation, the financial system may view small term liquidity because of financial binding measures. Following these conditions, LF performance doesn’t get affected. So, they determine to be a reliable investment choice for short term surplus funds.

- Dropping Interest Rate Scenario

In dropping interest situations there is liquidity pressure in the system. From liquid and liquid plus scheme begin dropping their sheen. Irrespective of the market situations, LF serve well to help short term goals and requirements.

Must read: Mutual funds in India

Points to estimate as an investor

Things to consider as an investor

- LF is a little risky of all the debt funds. The NAV doesn’t vary too often because the underlying assets mature duration is 60-91 days. This limits the fund NAV from getting affected too much by the underlying asset value variations. Still, there might be an outcome of an unexpected fall in NAV. In a matter of an immediate decline of the credit evaluation of the underlying security.

- It has been determined to create returns in the range of 7-9 per cent. It is way greater than the small 4% returns received on a savings bank account.

- Liquid funds are particularly meant to invest excess cash over a very short span of time state up to 3 months. Such a short horizon helps to recognise the whole potential of the underlying bonds.

- If one needs to build an emergency fund, then liquid funds can determine to be very beneficial. In extension to get higher returns, this will assist to take out money quickly in a matter of difficulties.

Evaluation

Evaluation of liquid funds

- Fund past reviews represent a vital role in the choice of suitable funds. One must inquire about funds which have given regular returns across various time ranges.

- Select funds which have exceeded their profits limits always. Also, their equal funds in a regular way over say 3, 5 and 9 years.

- Remember to examine the fund performance which suits one’s investment limit to generate consistent results.

- Past of the fund house enhances an essential basis towards fund choice. Fund houses which have an excellent past with uniformity in the performance of the investment. The domain is named to be trusted to stay flexible while drops or market rally. A regular track record of 5-10 years is one can go for.

- Pick a fund with a less expense ratio so that further it gives a high-grade performance. Expense ratio determines the working effectiveness of a mutual fund scheme. It shows how the invested amount is used to handle the costs of the fund. A lower expense ratio renders into higher take-home returns for the investor.

- See for funds with a greater Sharpe ratio that means it provides greater returns on all extra unit of risk taken.

Top 10 Liquid funds in India

The liquid funds in India are very popular and the mentioned liquids funds have a star rating from 1-5.

| Scheme Name of liquid funds | 3 year | 5 year | 10 year |

|---|---|---|---|

| Franklin India LF – Super Institutional Plan | 7.19% | 7.77% | 7.89% |

| DHFL Pramerica Insta Cash Fund | 7.17% | 7.72% | 7.81% |

| JM LF | 7.18% | 7.74% | 7.81% |

| Baroda LF – Plan A | 7.17% | 7.72% | 7.81% |

| Quant Liquid Plan | 7.16% | 7.89% | 8.32% |

| Edelweiss LF – Super Institutional Plan | 6.93% | 7.45% | 7.70% |

| Aditya Birla Sun Life LF-Regular Plan | 7.13% | 7.70% | 7.85% |

| ICICI Prudential LF | 7.11% | 7.67% | 7.82% |

| Principal Cash Management Fund | 3.96% | 5.77% | 6.79% |

| Invesco India LF | 7.13% | 7.69% | 7.81% |

Conclusion

While choosing a fund, one requires to examine the fund in an informative manner. There are several qualitative and quantitative parameters. That can be used to reach genuine liquid funds as per investors requirements. Additionally, one must keep their financial goals, risk factor and investment range in mind.

For more details related to liquid funds -You can visit our website WealthBucket. A greater platform that offers all the services realted to mutual funds. We help investors get the qualitative services of equity fund investment, Liquid mutual funds, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund.

For a one to one chat, call us at +91 9999379929. Or Email at contact@wealthbucket.in.

Realted articles

Aditya Birla mutual fund schemes