Contents

- Understanding the Large capital Mutual Funds

- What do you mean by Large Cap Mutual Funds?

- Investors in Large Cap Mutual Funds

- How to invest in Large Cap Mutual Funds?

- Prospects Large Cap Mutual Funds offers

- Evaluation of Large Cap Mutual Funds

- Standard Deviation

- Alpha

- Sharpe Ratio

- R-Squared

- Advantages of Large Cap Mutual Funds

- The best performers of 2019 in Large Cap Mutual Funds

- Mirae Asset India Equity Fund-RG

- ICICI Prudential Bluechip Fund – Growth

- SBI Blue Chip Fund – GrowthLarge Cap Fund

- HDFC Top 100 Fund – Growth

- Franklin India Bluechip Fund – Growth

- Large Cap Fund: Investment in Indian stocks

- Conclusion

Understanding the Large capital Mutual Funds

Large Cap mutual funds are one of the types of equity mutual funds. means the size of the company’s profit in the stock market. An investor who is ready to invest a huge amount of money. Also, have the capacity to take a great risk then Large Capital Mutual Fund is the safest choice for such investors. Investors that explore to invest for long-term with steady returns must opt large-cap funds. Mutual fund investment is always based on the amount of investment and the requirements of investors who are investing in it.

The stock market is active in nature everyone knows that. Whereas Mutual Funds is conventional choices. As they invest a pool of money from investors to many diversified stocks and bonds. Also, enabling investors to own a portion of distinct securities.

SEBI has, vide it’s a circular marked large cap, mid cap and small cap companies in status to assure unity in respect of the investment universe for equity mutual fund schemes. Besides, SEBI has also specified that AMFI shall serve the record of stocks.

Read More about : How to invest in mutual funds

What do you mean by Large Cap Mutual Funds?

It is light in risk to invest in the company whose size of capitalization is greater. Thus, these funds are build up of shares from companies with high capitalization groundwork.

Investors invest a greater portion of their investment in companies that have a massive market capitalization. These are known for their steady returns over a duration of time. The companies of Large Cap funds are often masters in their field of business. So they manage to remain constant than small-cap or mid-cap companies throughout market volatility.

Large Cap companies do have a large amount of experience in the market. Also, lead a great performance record supported by strong corporate-governance systems.

Must Read: Choose Best Tax Saving Investment Option

Investors in Large Cap Mutual Funds

Investments are constantly directed to all individuals investment goals. Their risk profile and investment limit. High-grade Large Cap Mutual Funds are ideal for investors who want to receive returns without being shown to severe market fluctuations. The comparatively light aggressive investor may evade risky small-cap schemes and choose Large Cap Mutual Funds.

For a first-time investor, a large Cap Mutual Funds are a great choice. The underlying companies have an account of several years of uniform performance throughout the ups and downs of the market. Investors must recognise that these funds may not post very large returns even at the time of positive market provisions. But the returns from these funds will be light active.

How to invest in Large Cap Mutual Funds?

Large-cap funds are very familiar with investors due to their steady returns and low risk. There are several schemes accessible in the market. Since in the companies these funds invest are equitably well set.

However, a qualified fund manager can create a difference in the returns earned by a large-cap fund. It’s satisfying to do a measurement of returns of various schemes before picking one. Remember to take into record expense ratio as one never want to invest in a fund that has a great ratio.

The investment in large-cap funds is done straight through the AMC or a distributor. A distributor can give a broader range of options than a mutual fund company. Considering the previous proposals schemes from various companies. Which will let one perform the maximum option. Investing online is an added option as one can do it very speedily. In case one is not a 1st-time investor in mutual funds and have KYC done, investing online should be the 1st preference.

Prospects Large Cap Mutual Funds offers

The investors favour investing in Large Cap Mutual Funds in big blue-chip companies. The reason is they are financially stable as contrasted to other companies. Investors, however, favour these companies also their shares are greater priced.

The great price is value towards the assurance that the shares offer. Those investors who look for long term capital recognition see Large Cap Mutual Funds be the perfect option for investment.

The return on the large-cap mutual fund may be reasonable to low. But they are more apt to be constant over a period of time. The possibility that the corpus of the investor will receive consumed is low in these funds when contrasted with mid caps and small caps mutual funds.

Simply big blue-chip companies are in the state to resist the economic recession. Also, improve quicker after the market fall. The main benefit the large-cap fund gives is steady returns with economic risk.

Evaluation of Large Cap Mutual Funds

As an investor must see at some economic ratios to estimate funds. Few of the major ratios counts are as follows:

Standard Deviation

The distribution of a set of data from its mean or average is measured through Standard deviation. Standard deviation in finance shows the volatility of investment from its yearly rate of return. The stock has a greater standard deviation will comprise of the higher price range. That repeatedly is significatory of larger volatility in contrast to stocks with a decreased standard deviation.

Alpha

A fund manager’s capacity to gain a profit when the benchmark also registering profit estimates by an Alpha. Alpha can be similar to 1.0 or even shorter or longer than 1.0. The bigger the Alpha, extra is the capacity of the manager to obtain profits from the benchmark movements.

Sharpe Ratio

Sharpe ratio estimates the risk-adjusted return of a portfolio. If a fund has a greater Sharpe ratio it indicates that it is seen as a portfolio that is almost higher related to its peers.

Sharpe ratio = (Mean portfolio return − Risk-free rate)_Standard deviation of portfolio return

R-Squared

The R- Squared is reflected by the percentage of fund returns that drop in line with benchmarks of return. The value of R-Squared rests within 0 and 1. Also, is expressed as percentages from 0 to 100%. A fund with an R-Squared of 100% will have its protection’ movements defined by the changes in the index. A greater amount of R-squared suggests a higher useful beta figure.

Advantages of Large Cap Mutual Funds

- Large-cap mutual funds have served greater returns to investors in the short term.

- The assist in uniform wealth creation and pay out dividends on a regular basis.

- They have the ability to face and bear markets at its up and downs.

- The earlier performance of the company and its activities can help in the precise measurement of the cost.

- Large-cap fund investments give regular and low-risk returns.

Also Read: NAV all you need to know about it

The best performers of 2019 in Large Cap Mutual Funds

This table mentioned below is the best performer of the year with 1,3,5,10 years of return percentages along with the name of the schemes of large-cap mutual funds.

| Schemes Name | 1 year | 3 year | 5 year | 10 year |

|---|---|---|---|---|

| Mirae Asset India Equity Fund-RG | 11.25% | 17.65% | 15.99% | 18.15% |

| ICICI Prudential Bluechip Fund – G | 9.01% | 16.44% | 13.52% | – |

| SBI Blue Chip Fund – G | 5.17% | 11.86% | 14.05% | 13.56% |

| HDFC Top 100 Fund – G | 15.91% | 17.55% | 17.55% | 14.15% |

| Franklin India Bluechip Fund – G | 5.56% | 10.15% | 10.49% | 12.42% |

Notes: RG stands for regular growth

G stands for growth

Learn about: Direct Plan vs. Regular Plan: Which is Best for your Mutual Fund Investment

Mirae Asset India Equity Fund-RG

It is a scheme in which has an investment objective is to originate long-term capital recognization by capitalizing the capacity investment opportunities by investing in equities of large-cap companies. It is preferred for Investors who are seeing to invest money for at least 3-4 years and viewing for great returns. At the same time, these investors should also be available for the chance of straight losses in their investments.

The image mentioned below will show you the present working of these funds.

Mirae Asset Large Cap fund growth graph

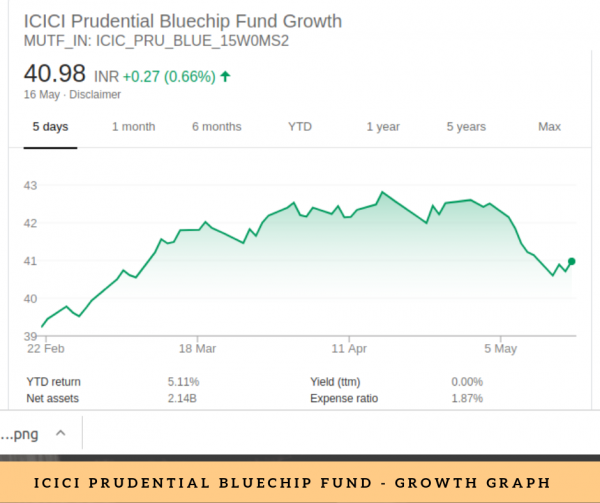

ICICI Prudential Bluechip Fund – Growth

ICICI Prudential Bluechip Fund launched on May 23, 2008. It is an open-ended equity scheme predominantly spending in large-cap stocks. These Large-cap companies are recognised brands with a demonstrated track record. The quality management and are between the business behemoths of India. The scheme attempts to present extension and balance to an investor’s portfolio and may turn out to be a great investment choice in turbulent economic circumstances.

The image mentioned below will show you the working of these funds on 16 May 2019

ICICI Prudential Bluechip Fund – Growth Graph

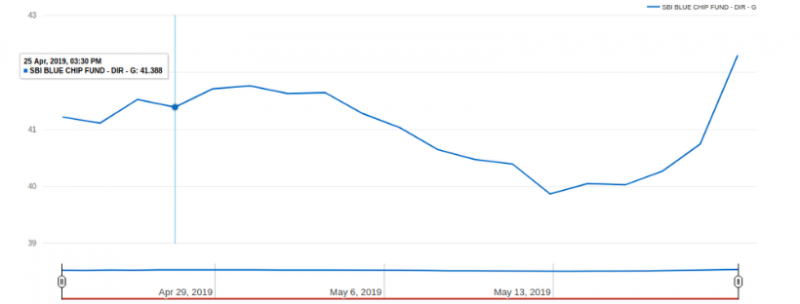

SBI Blue Chip Fund – GrowthLarge Cap Fund

To give investors with chances for long-term extension in capital through active management of investments in a diversified box of large-cap equity stocks (as specified by SEBI/AMFI from time to time).The scheme supports a combination of growth and value style of investing. The scheme will serve a mixture of top-down and bottom-up strategy to stock-picking and prefer companies across sectors.

The image mentioned below will show you the working of these funds on 26th April-13 May 2019

SBI Blue Chip Fund – Growth Graph

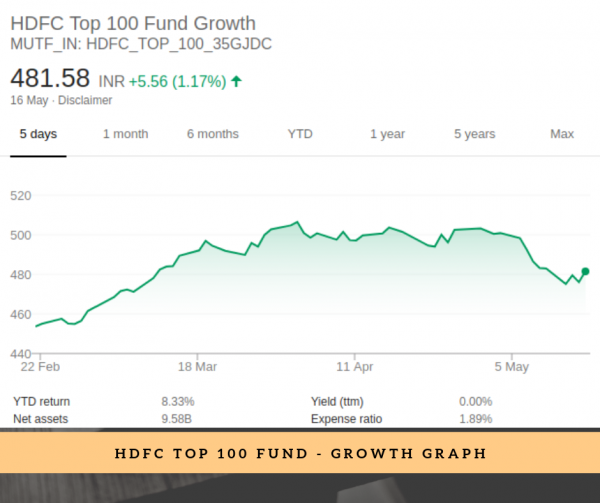

HDFC Top 100 Fund – Growth

The Scheme intends to produce long-term capital recognition. It will secure the least exposure of 80% to Large Cap stocks. As described by SEBI, which presently are the 100 largest companies in India in terms of full market capitalization.

Generally, large-cap companies are well-established businesses that are in order for a longer period of time. Also, are well placed to learn business pressures over multiple market cycles. Due to their dimension, they also profit from economies of scale.

The Scheme will continue diversified over key sectors and economic variables. The image given below will display you the growth of these funds on 16 May 2019

HDFC Top 100 Fund – Growth graph

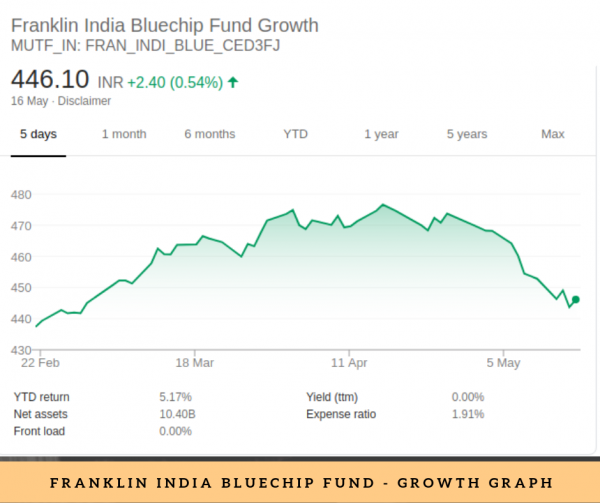

Franklin India Bluechip Fund – Growth

Franklin India Bluechip Fund predominantly invests in companies that work great and built businesses. The companies

having a long track record. The fund has announced a dividend each year for the last 20 years.

Franklin India Bluechip Fund – Growth graph

Large Cap Fund: Investment in Indian stocks

The table mentioned below will help you to understand the amount percentage of investment in Indian stocks by each scheme. Along with the total amount distribution of stocks percentage among the Large-cap funds, Mid-cap funds and Small-cap funds.

| Name of the scheme | Investment in Indian stocks | Large Cap Fund | mid-cap funds | Small-cap funds |

|---|---|---|---|---|

| Mirae Asset India Equity Fund-RG | 95.2% | 83.42% | 8.18% | 3.58% |

| ICICI Prudential Bluechip Fund – G | 88.82% | 85.4% | 2.98% | 0.2% |

| SBI Blue Chip Fund – G | 95.42% | 84.75% | 9.88% | 0.79% |

| HDFC Top 100 Fund – G | 99.55% | 90.45% | 9.07% | – |

| Franklin India Bluechip Fund – G | 93.2% | 84.75% | 6.21% | – |

Note: SBI Blue Chip Fund has 0.22% investment in Debt funds of which, 0.22% in funds invested in extremely low-risk bonds.

ICICI Prudential Bluechip Fund – Fund has 3.13% investment in Debt of which 0.07% in Government securities. Also, 3.06% in funds invested in quite less-risk bonds.

Read more: Mid-cap funds -Who and how to invest in it

Conclusion

To take the right investment decisions during the market down and up, we need to have very clear guidelines for making financial decisions. To have very clear financial guidelines, one should have a sound financial plan. And an investor should invest according to the plan and the financial goals and objectives.

The large-cap funds are the best way of investment for investing in this fund you can cater to services provided by our company WealthBucket.Do visit our website for numerous services linked with funds like equity fund investment, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund, SIP Calculator and many more.

Give calls us at +91 9999379929. You can also email us at contact@wealthbucket.in

Related Articles