Contents

Introduction

Permanent account number or PAN is a 10 digit unique identification number allotted to every Indian citizen. So, it becomes a necessity to know your PAN card details. It was introduced to keep in check the financial transactions taxable in nature. It records every transaction made and thus no 2 persons can have the same PAN number.

Check out Procedure to apply for lost pan card

PAN card Transactions

For the transactions given below, the PAN card is mandatory.

- If you wish to transfer funds from NRE to NRO account

- Remit money globally

- Buying an insurance policy of Rs.50,000 or more

- Purchasing shares of Rs.50,000 or more

- Sell or purchase an immovable property worth Rs. 5 lakh or more

- Buying or selling a vehicle (excluding 2 wheelers)

- Expenses incurred in hotel payments or restaurant payments equal Rs.25,000 or more

- If you wish to buy schemes of mutual funds

- Depositing Rs.50,000 or more in your bank account

- Proof of identification for a taxpayer

- Record of taxes for a taxpayer

- PAN card is used to opt for connections in gas, water supply, etc.

- The total number of transactions and the value of each transaction can be checked by a taxpayer.

Suppose you have lost your PAN, but you need your PAN to make any of the transactions mentioned above. So, to rescue you from such a situation, the Income Tax Department has an alternative approach to know your pan. By mentioning some of your personal details, you can get in touch with your PAN number.

Steps to know your PAN

To know your PAN, follow these steps

Step 1 to know your PAN

Visit Income tax e-filing website https://www.incometaxindiaefiling.gov.in/home

Step 2 to know your PAN

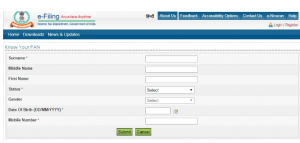

After clicking on the link, mention all the relevant details in the given field.

Step 3 to know your PAN

Now, you need to select your status from the drop-down. The options given are individual, Hindu Un-divided family, Association of Persons, Body of Individuals, Company, Government, Artificial Juridical Person, Local Authority, Firm or Trust.

Step 4 to know your PAN

Then, you need to select your gender in the case of an individual. But otherwise, it is optional in all the other cases like for the Body of individuals, Company, Government, etc.

Step 5 to know your PAN

Next, feed in your date of birth.

Step 6 to know your PAN

After the last step, you need to feed in an active mobile number to receive an OTP.

Step 7 to know your PAN

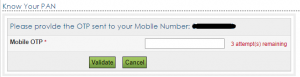

Finally, check your phone to know the OTP (One Time Password) and then enter this OTP. Click on the validate option to get your PAN.

Step: 8 to know your PAN

You can see the PAN, jurisdiction, and the status of PAN from the screen.

Benefits of PAN card

It is important to know your pan so that you can see the various benefits of having one. Some of those benefits are as follows

- If a person wishes to pay online direct tax, then PAN is compulsory.

- Details of PAN is necessary for starting a business.

- For an honest Indian paying Income tax, a PAN card is necessary.

- To undertake a financial transaction, like buying/selling a property, vehicle, etc. PAN Card is a must.

Know your PAN card’s validity

PAN card is valid for the lifetime of an individual. PAN card has no expiry date.

Conclusion

It can be said that the PAN card is a necessity for every Indian citizen/organization/institution or any other to follow honest dealings and to curb black money.

WealthBucket is a platform that deals at mutual fund investments. To avail services like equity fund investment, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund, click on any of the given tabs. You can also visit our website WealthBucket or call us at +91 9999379929. Email us at contact@wealthbucket.in

Related articles

KYC: Definition, Objectives, Check Status and Process

Why you should opt for eKYC for your Mutual Fund Investments