Contents

- Introduction to mutual funds

- Kinds of Mutual Funds

- Equity or Growth Schemes

- Tax Saving Funds

- Debt Funds

- Exchange-Traded Funds (ETFs)

- Balanced Funds

- Glit Funds

- How to invest in Mutual Funds A writeup on benefits of mutual funds

- Recognize your plan for investing in mutual funds

- Fulfilment of KYC requirements

- Understand about the mutual fund’s plan and schemes accessible

- Examine and analyze the risk factors

- Steps for mutual funds investment

- Measures to invest in Mutual Funds

- Direct investment with mutual fund house – Offline

- Brokers involvement in investment- Offline

- Official Websites – Online

- Official app – Online

- Values linked with investing in Mutual Funds

- Reason for investing in Mutual Funds

- Professional management

- Higher returns

- Diversification

- Convenience

- Low cost

- Disciplined investing

- Points must know while investing in Mutual Funds

- Conclusion

Introduction to mutual funds

The common question every investor is to how to invest in mutual funds?

A Mutual Fund is an investment scheme that assembles money from people. Further, invests the money into various mutual fund plan and assets. For example, SIP investment, Equity Mutual Funds, Debt fund, Liquid Funds etc. The money collected from different investors is genuinely investing in Financial securities.

- Shares: A share of a mutual fund describes investments in multiple stocks or additional securities rather of only single holding. Investors generally receive a return from a mutual fund. It has in 2 ways.

- First, income is gained from dividends on stocks.

- Second, interest on bonds kept in the fund’s portfolio.

- Money market: Certificates of deposits and bonds.

Debt, Equity and money-market tools are all-inclusive kinds of asset classes. These investments are for the medium term long term or short term. The set of asset invested in also defines the risk factor of the funds. Best mutual funds will always help to grow investors.

Read more about: Mutual Funds Overview

Kinds of Mutual Funds

Today, with over numerous mutual schemes accessible in the market. Put the mindset of people and investors in great confusion. The responsibility of choosing the right mutual fund is a way more difficult task. How to invest in mutual funds is another good question.

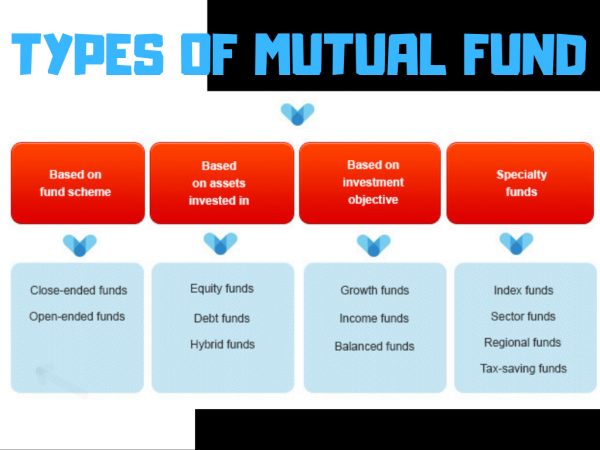

Mutual funds varieties are broadly categorised on the base of –

- Investment objective

- Structure

- Nature of the schemes

When organised according to the investment objective mutual funds can be of seven kinds –

- Equity or growth funds

- Fixed income funds or debt mutual funds

- Tax saving mutual funds

- Money market or liquid funds

- Balanced funds

- Gilt funds

- Exchange-traded funds (ETFs).

types of mutual fund

Kinds of mutual funds depend on the following factors mention below.

Equity or Growth Schemes

Equity schemes invest in equity shares. The investment objective is to gain capital for long or medium-term.hey are linked with huge risks. The risk factor is they are associated with the extremely active stock markets but over the long term. They give great returns.

So, investors having a large desire for risk. Will view these schemes to be perfect investment options. Growth funds can moreover be divided.

- Diversified

- Index funds

- Sector

Tax Saving Funds

People who are looking to develop their capital along saving tax – Tax saving schemes is the right option. The Tax rebates are enjoyed by the investors under the 1961 Section 80C Deduction of the Income Tax Act within tax-saving funds. It is also known as Elss Equity-linked savings schemes.

Debt Funds

The people who want fixed income or debt securities.

- Corporate bonds

- Commercial papers

- Government securities

- Debentures

- Multiple money market instruments

For those who inquire a constant, reserved and risk-free income- debt funds can be a perfect option. There are subcategories of Debt Funds.

- Short-term mutual funds and plans

- Income funds

- Gilt funds

- Liquid Mutual funds

- Monthly Income Plan

Exchange-Traded Funds (ETFs)

The ETF offers the versatility of trading units on the stock exchanges. This is because of ETF trades in a stock exchange. Also, it owns a set of assets. For example gold bars, foreign currency, bonds etc.

Balanced Funds

A balanced mutual fund is a balancing of the funds. These funds invest in a blend of equity shares and debt instruments. The investors assume constant progress and income at the same time while investing in these funds. They deliver a profitable investment choice for investors. If they are ready to face the risk for medium or long-term.

Glit Funds

The people who want to grow part of the nation-building process with earing return on the investment you made- Gilt funds are a perfect choice. They invest in fixed interest giving securities of state and central goverment. The money is used in building infrastructures and other goverment expenses.

Learn About: A writeup on benefits of mutual funds

How to invest in Mutual Funds A writeup on benefits of mutual funds

It’s important to cater to the points mentioned below before you ask the question of how to invest in mutual funds. Doing so will make a decision format easy and one will invest in the right kind of mutual fund. That would further help in wealth creation.

Recognize your plan for investing in mutual funds

The most important step taken as first for investing in a mutual fund. One must determine his/her investments goals. For example Child’s Education, Buying a house, retirement plan etc.

In case one does not have a particular goal. At least have a clear mindset on how much money one wishes to acquire in what time. Recognize an investment purpose will cater the investor the investments choices based on the payment method, lock-in period and level of risk involved etc.

Fulfilment of KYC requirements

For investing in mutual funds the investor requires to follow the KYC ( Know Your Customer ) guidelines. The investor asks to submit copies of Address Proof, Age proof, PAN card details and many more as stated by the mutual fund company/ house.

Understand about the mutual fund’s plan and schemes accessible

The mutual fund market is overwhelmed with wide choices. The schemes and plans fit in almost every requirement of investors. Before investing keep in mind that one has observed the market. This will help an investor to learn the various kind of schemes available.

After exploring follow it with an investment objective plus the risk involved. Also, cater to the budget and look for the best-suited scheme. The financial advisor is available to guide investors about which scheme to invest in. Take care of retrieving more and more returns.

Examine and analyze the risk factors

When investors invest in mutual funds they should know that there is a set of risk involved. The plans or schemes having a large number of returns involves most of the risk.

In case an investor wishes to have high returns with high risk-Invest in Equity schemes or plans. If investors want to eliminate high-risk factor and happy with average risk-Debt schemes are a perfect pickup.

After exploring all the mentioned points investors can cater to mutual fund schemes and start investing in them. A bank account is compulsory for making mutual fund investment.

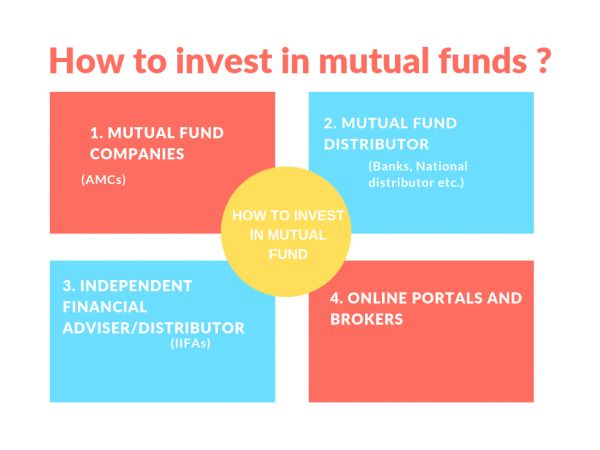

how to invest in mutual funds

Steps for mutual funds investment

- Step 1: Sign up for an account at WealthBucket.

- Step 2: One requires to enter all details. For example Investment amount and Time period of investment.

- Step 3: Get the KYC process complete in a few minutes

- Step 4: Invest in a preferable mutual fund mentioned in the website.

Measures to invest in Mutual Funds

There are different mediums to invest in a mutual fund.

Direct investment with mutual fund house – Offline

One can invest in mutual fund schemes by reaching towards the nearby branch office of mutual funds. Please do carry the copies of the following documents mentioned below :

- Address proof

- ID proof

- Cheque leaf cancelled

- Photograph Passport size

The application will be given by the mutual fund house in India which demands to fill all details. After that, submit it along with all the mandatory documents.

Brokers involvement in investment- Offline

A broker /Distributor of a mutual fund is the one who will help in the whole procedure of mutual fund investments. They charge for it.He/she will give investors all the details of investments. The Details can be Features, documentation required and facts about the mutual fund schemes and many more. They will render perfect guidance on the schemes to invest in.

Official Websites – Online

The fund houses nowadays provide online websites facilities of mutual funds. Follow up all the instructions mentioned in the official sites of fund houses. Mention all the relevant details and submit it. The KYC procedure can complete online by filling all the documents and details. For KYC mention Aadhar number and PAN.

The data will be confirmed at the backend. Once the confirmation is done, start investing. Its the most perfected measure in mutual funds.

Official app – Online

Mostly all the mutual fund houses allow the investor to access their mobile applications. Further, download it for making an investment. The apps provide the facility of investing in schemes, outlook account statements, review details concerning folio and buy or sell units.

Read more: CAMSonline

Values linked with investing in Mutual Funds

The value of the fund is estimated as per the NAV value ( Net Asset Value). That value of the fund’s portfolio is a net of expenses. This is measured later by AMC.

AMCs will charge investors an execution fee. That includes their brokerage, salaries, advertising and extra official expenses. This is normally covered practising an expense ratio.

AMCs can also charge loads. That are essentially sales charges acquired by the company in the form of distribution costs.

In case one is unknown with associated charges. He/she might get into a situation where the profits from your investment decrease. Considerably because of overhead expenses. Therefore, it’s a great habit to study the little information on expenses and fees associated with a Mutual Fund.

Learn about: Criteria of selecting mutual funds

Reason for investing in Mutual Funds

Professional management

Mutual funds are regulated by licensed fund managers. Who analysis and hold a record of the markets. Also, recognise the rights stocks and buy plus sell them. At a suitable period to create desirable returns on investment.

The Best Fund managers in India examine the performance of firms before they choose to invest in their stocks. Plus, when an investor purchase units of a mutual fund scheme. The details of the scheme document will consist of the expert summary of the fund manager. That adds the no. of years of work experience. The variety of funds managed. Also, the performance of the funds managed.

Higher returns

Contrasted to term deposits such as Fixed Deposits, Recurring Deposits etc. Mutual funds give greater returns on investments by investing in a kind of tools. Equity mutual funds offer an engaging chance to investors to experience greater returns. But at the same time are followed by big risks.

Therefore, an ideal for investors would choose Debt funds. As it suggests moderate risk and retrieves better returns than term deposits.

Diversification

Possibly one of the largest advantages that mutual funds give is diversification. By investing in an extensive variety of asset classes and stocks. Mutual funds decrease the risk by changing the portfolio.

Accordingly, if an asset or stock is not functioning well. The review of additional assets can balance it out. One can yet enjoy beneficial returns on investment. To decrease the risk more change your portfolio by investing in various kinds of mutual funds. Take the advice of a financial advisor. They will guide if one is not sure about which funds to invest in. Also, how to change or adjust the portfolio.

Convenience

Spending on mutual funds is swift, hassle-free, and easy by many mutual fund houses. Who gives the online means of investing. In a click, some buttons begin investing in a mutual fund scheme. Even the KYC process can now be made online and investors can invest.

Low cost

One can begin investing in a mutual fund from a low amount (Systematic Investment Plan). Hence, do not need to wait to collect a large sum in order to begin investing. Plus, if invest in a Direct Plan of a mutual fund scheme, one does not have to pay any extra commission to brokers.

Disciplined investing

To develop a way of constant investing, mutual funds offer a facility SIP. A SIP enables investors to invest small amounts usually. The duration can be weekly, monthly, or quarterly.

An auto-debit facility is set up for SIP. Where a fixed amount will automatically debit from the investor’s bank account every month. A SIP gives a great plan to spend always.

Points must know while investing in Mutual Funds

- One should review the exit load which a particular mutual fund scheme will charge. An exit load is imposed when an investor trades units of a mutual fund in an appropriate tenure. So it is important that one must invest in a fund with a low exit load. Also, extra important to stay invested for the long-term.

- It is advised to choose a mutual fund scheme, which has got a low expense ratio.

- The prior performance of a mutual fund scheme is relevant in examining a mutual fund. Just recognise that prior performance is not all. As it may or may not be provided in future. Therefore should not be accepted as the single parameter to choose mutual funds.

- Fund sponsor is people who believe of beginning a mutual fund house. They address the capital market regulator that is SEBI. SEBI is history checks in India.

- While the trustees allow the job of managing investors money to the Asset Management Company. Control over the experience of the fund management team assures one will give money into deserving hands.

Must Read: Mutual Funds Investment: Top 5 to consider in 2019

Conclusion

For choosing wisely one need to know all about how to invest the mutual fund. That will cater to the best services from the different mutual fund houses. The perfect fund manager will help you the most in explaining all the schemes of the mutual fund. The financial advisor will guide the best scheme according to your needs and requirements.

If you are looking perfect schemes and plans of mutual funds do log in to our website WealthBucket.We offer numerous services of mutual funds Equity Mutual Funds, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund. For contacting us through phone call +91 9999379929. Email your doubts about mutual funds on contact@wealthbucket.in.

Related Articles

Adding SIP Biller for online payment