Contents

- Introduction to debt funds

- Who invests in debt funds?

- Working of debt funds

- The base for the Evaluation of debt funds

- Steps for investing in mutual funds online

- Step 1

- Step 2

- Step 3

- Step 4

- Advantages of Debt funds

- Types of debt funds

- Liquid Funds

- Hybrid Funds

- Floating Rate Funds

- Corporate Bond Funds

- Ultra Short Term Funds

- Ways by which debt Funds generate returns

- Tax Processing of Debt Funds

- Points to refer while investing in debt funds

- Best performing -DMF schemes in 2019

- Frequently Asked Question (FAQs)

- Conclusion

Introduction to debt funds

The debt mutual funds (DMF) are a part of mutual funds that usually invest in a blend of debt or fixed income securities like :

- Treasury Bills

- Government Securities

- Corporate Bonds Money Market instrument.

- Other debt securities of varying time limits.

Generally, debt securities have a set maturity date & pay a set rate of interest. The main purpose to invest in a debt fund is to acquire assets by centres of interest income. Also, the uniform recognition of the fund amount. The underlying securities produce interest at a set rate during the tenure for which one stays invested in the fund.

They may invest in short or long-term bonds. The results can be securitized, money market instruments or slowing carrying rate debt. The expense ratios on debt funds are usually lower. Debt funds invest in different bonds, based on their credit grades

Learn more: Best mutual funds schemes to consider investing in 2019

Who invests in debt funds?

Risk-averse investors usually prefer to invest in debt fund schemes. Investors that are ready for the possibility of a low, but steady rate of returns versus high-risk exposure capital recognition equity funds prefer debt fund schemes. One may require to invest in debt funds if:

- Have excess funds to place for a while, and don’t object in taking a little bit of risk for the chance of returns greater than a savings bank account or an FDs.

- One wants to gain bigger returns than an ordinary fixed deposit scheme.

- When one not satisfied with the prevailing rate of returns given by your savings bank account.

- One requires to increase their current income. If the prevailing salary is not capable to satisfy the needs of your lifestyle. One can invest in a debt mutual fund scheme. To supplement a set amount of income every month.

Working of debt funds

Debt mutual funds invest in various securities with the base of credit grades. A security’s credit rating means whether the issuer will default in paying the returns they guaranteed. The fund manager of a debt fund assures that he/she invests in great credit quality instruments.

A leading credit rating indicates that the entity is extra likely to pay interest on the debt security regularly. As well as pay back the capital amount upon maturity.

That’s why debt fund which invests in high-level securities will be slight volatile, corresponded to low-level securities. Additionally, maturity depends on the investment policy of the fund manager. Plus, the all over interest rate regime in the economy.

A declining interest rate regime helps the manager to invest in long-term securities. A growing interest rate regime helps him to invest in short-term securities.

The base for the Evaluation of debt funds

- Fund returns

- Funds HistoryAsset allocation in Fund Portfolio

- Credit rating profile

- Expense ratio

- Stated investment horizon

These should be the base of evaluation for debt funds one can cater while investing in it.

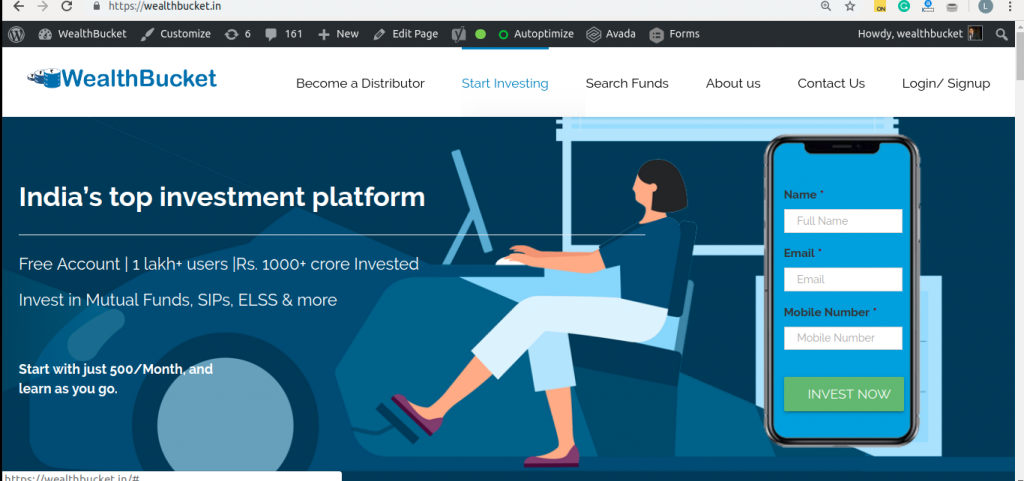

Steps for investing in mutual funds online

Invest in debt mutual funds under the following steps :

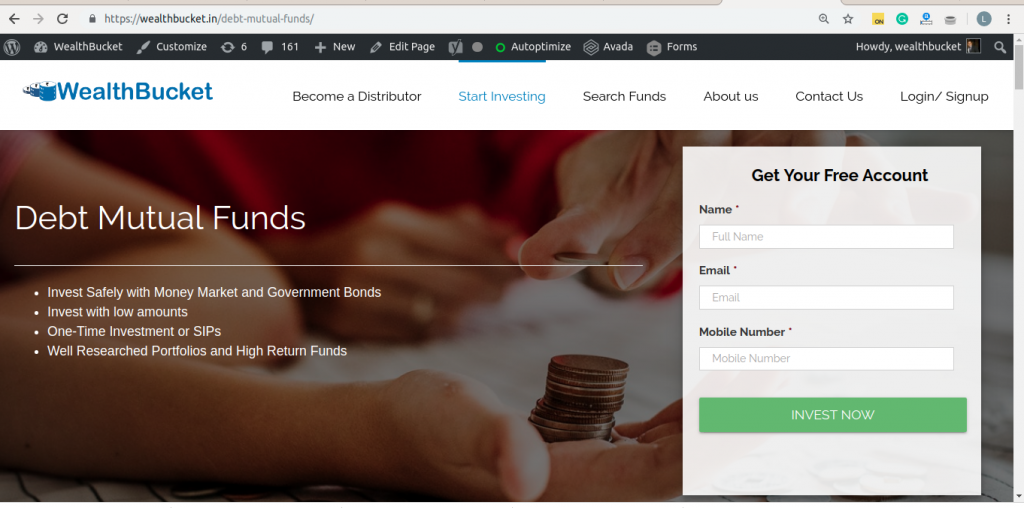

Step 1

Logging on to a mutual fund website

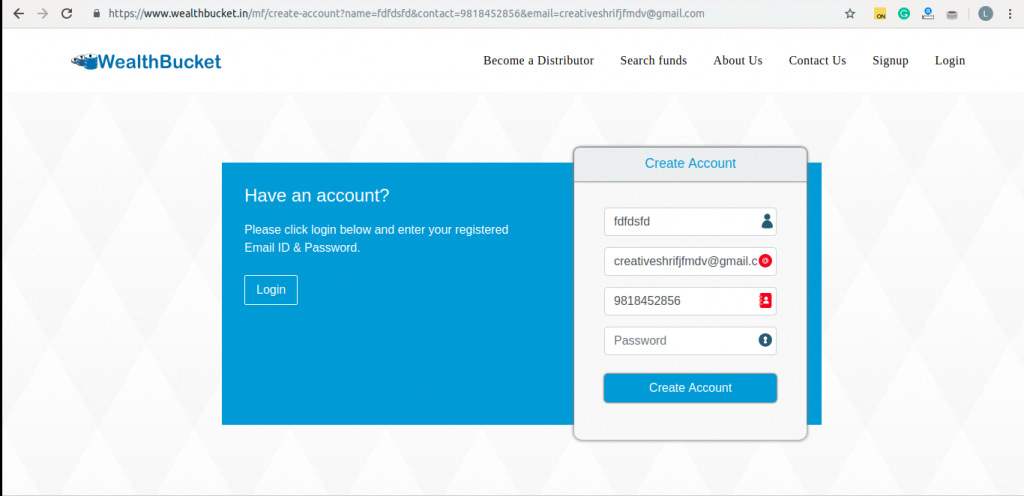

Step 2

Formulating a free investment account

Step 3

Submit KYC documents and details online

Step 4

sit back and invest in debt mutual funds easily.

cater to all the steps mentioned above for hassle-free investment in debt funds.

Advantages of Debt funds

- Debt mutual fund schemes are usually seen as an alternative investment to FDs.As they give income over time.

- Debt mutual fund schemes, particularly liquid funds, hold a great range of liquidity. Investors can cash out their investment instantly than maximum other similar investment choices.

- Money that’s been spent in a debt fund scheme can usually simply be given to an equity mutual fund.

- When linked to popular options like savings bank accounts or fixed deposits, debt mutual funds grant the hope of far greater returns.

Types of debt funds

There are many types of debt funds to invest in some of them are mentioned below:

Types of Debt Mutual funds

Liquid Funds

Liquid funds are also called as Money Market Funds. These funds invest in extremely liquid money market instruments and give secure liquidity.

Liquid Funds propose to earn money market rates. Also, can assist as an option to corporate and individual investors for depositing their amount of cash for short-term periods. Returns on these funds tend to shift less if matched with other funds.

Hybrid Funds

Hybrid funds invest in both debt instruments and assets to achieve the highest diversification and secured returns. They bridge the distance between debt and equity schemes by investing in a blend of equity and debt securities. Hybrid funds propose to complete capital appreciation in the long-run. Plus create income in the short-run by a balanced portfolio. The fund manager earmarks money in differing proportions in debt and equity based on the investment objective of the fund.

Floating Rate Funds

These funds essentially invest in floating rate debt securities. Where the interest paid variations in line with the fluctuating interest rate situation in the debt markets. The periodical interest rate of the securities retained by these products is reset with relating to a market benchmark. This addresses these funds fit for investments when interest rates in the markets are growing.

Corporate Bond Funds

These funds invest mostly in corporate bonds and debentures of diverse maturities that give comparatively higher interest. Also, are disclosed to greater volatility and credit risk. They work to give regular income and extension. Plus fits in investors demands of reduced risk appetite with a medium to the long term investment limit.

Ultra Short Term Funds

They invest in extremely short term debt securities. With a little portion in longer-term debt securities. Earlier it was called as Liquid Plus Funds. Maximum ultra short term funds do not invest in securities with a surplus maturity of higher than 1 year. These funds are favored by investors who are ready to marginally maximize their risk. With an intention to earn corresponding returns. Investors who have short term excess for a time duration of about 1 – 9 months can go for these funds.

Read more about: Best Monthly Income Plan to consider investing in 2019

Ways by which debt Funds generate returns

There are 3 parts mainly influence the returns on debt funds.

- Credit risk

- Liquidity risk

- Interest rate risk

Debt funds produce returns in 2 ways.

- First, Way of interest -coupon rate

The fixed income securities or bonds, they operate feature of a decided interest rate named as the coupon rate.

- Second, The value of their bonds and other fixed-income

The use of their bonds and other fixed-income holdings fluctuate due to credit rating movements plus the economy-wide interest rate.

Tax Processing of Debt Funds

Capital gains or profits and dividends gains on mutual funds charges or tax separately. After the investor gets them dividends are not taxable in case of debt funds. Though a dividend deal tax is payable straight by the fund house to the government.Before it transfers the investor and this is covered in the expense ratio of the fund. With regard to capital gains tax, this is chargeable in the guidance of the investor.

Choose Best Tax Saving Investment Option for debt mutual funds. Capital profits can be charged as short term capital gains or long term capital gains. All depending on how long units of the debt fund were secured prior to being switched or redeemed. These funds earnings come below the concerning of short-term capital gains. In case the fund’s units have been kept for shorter than 3 years from the date of unit allocation. Before they were redeemed or switched to a diverse scheme.

These short term gains are charged according to the investor’s income tax slab. Such profits are involved in the annual income of the investor following the income from different origins ahead in the ITR form.

Do learn: Tax Saving Mutual Funds: Compare & Invest in the Best ELSS options

Points to refer while investing in debt funds

- Debt Fund intends to gain optimal returns by managing a diversified portfolio of different kinds of securities. One can assume them to work in an expected manner. The debt funds are famous with moderate investors is the reason.

- Debt funds can be applied to obtain a kind of goals like the purpose of liquidity or for gaining additional income.

- The charge on debts funds is- an expense ratio to handle one’s money. Till now SEBI had made compulsory the top limit of expense ratio be 1.05%.

- These funds are fixed-income, they don’t give guaranteed returns. The NAV of a debt fund does drop with an increase in the all over interest rates in the economy. So, they are fit for a declining interest rate regime.

Best performing -DMF schemes in 2019

Below mentioned all the best performers in debt mutual funds returns and are updated on date 17th May 2019.Along with their ranking level from 1- with a performance from 3-5 years.

| Name of the funds | 3 year | 5 year | Rankings(1-5) |

|---|---|---|---|

| IIFL Liquid Fund-Regular Plan | 6.59% | 7.15% | |

| Sundaram Banking & PSU Debt Fund | 6.81% | 7.55% | |

| Tata Short Term Bond Fund-Regular Plan | 4.65% | 6.38% | |

| DSP Short Term Fund-Regular Plan | 6.63% | 7.61% | |

| Motilal Oswal Ultra Short Term Fund-Regular Plan | 1.05% | 3.32% | |

| Franklin India Dynamic Accrual Fund | 8.94% | 9.65% | |

| BNP Paribas Liquid Fund | 7.09% | 7.62% | |

| Kotak Liquid – Regular Plan | 7.08% | 7.65% | |

| HSBC Low Duration Fund | 8.78% | 9.11% | |

| Invesco India Liquid Fund | 7.13% | 7.69% | |

| HDFC Credit Risk Debt Fund-Regular Plan | 7.24% | 8.49% | |

| SBI Magnum Gilt Fund | 8.06% | 10.14% | |

| Canara Robeco Savings Fund-Regular Plan | 7.35% | 7.85% | |

Frequently Asked Question (FAQs)

1)What do you mean by debt instrument?

Ans) A debt instrument is an electronic legal obligation or a paper that allows the issuing party to borrow funds. By agreeing to repay a lender in accordance with terms and conditions. For example, instruments like notes, bonds, debentures, certificates, etc.

2) Are debt funds safer than equity funds?

Ans) Yes the debt funds are much safer than equity funds as they essentially invest in measured and risk-free state and corporate bonds.

3)The bonds are debt or equity?

Ans)Bonds are often related to as fixed-income securities because the lender can expect the correct amount of cash. The fixed income is involved in debt funds only. So, they are debt funds.

4)Which of the companies are best for the liquid fund investment?

Ans) There is a list of best mutual funds according to their rating. But the best 5 More Best Liquid Funds are

- Aditya Birla mutual fund

- HDFC mutual fund

- L&T Liquid Fund – Direct-Growth

- Kotak Mahindra mutual funds

- HSBC Cash Fund

5) Do nav of debt funds vary?

Ans)The NAV (Net Asset Value) of a bond fund/debt fund may vary over time. Unlike an exclusive bond in which the entire issue price will be returned upon maturity.

Conclusion

A debt fund is a kind of mutual fund which predominantly invests in fixed-income securities. Though, according to the Income Tax Act, any fund which spends less than 65% of its entire assets in investments is termed as a debt fund.

WealthBucket is a great website that deals in mutual funds investments. Cater to the advantages of our services like equity fund investment, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund. You can tap on given tabs. Either visit our website WealthBucket. One can give us a call us at +91 9999379929. You can also email us at contact@wealthbucket.in for any query linked with mutual funds and its investment.

Related Articles

How a Mutual Funds Calculator works