Contents

- Equity Mutual Funds

- Top 10 best equity mutual funds schemes to invest in

- Small-Cap Mutual funds (Equity)

- Large -Cap mutual funds

- 10 best Large-Cap mutual funds schemes to invest in

- Multi-cap mutual funds

- 10 best Multi-Cap mutual funds schemes to invest in

- Debt Mutual Funds

- Best 10 Debit mutual funds schemes to invest in

- Liquid Mutual funds

- Out of the many- best 10 Liquid mutual funds schemes

- Balanced mutual funds

- Out of the various funds best 10 Balance mutual funds schemes

- Income Mutual funds

- From of the various funds best 10 Liquid mutual funds schemes

- Short Term Mutual Funds

- From several funds-best 10 Short-term mutual funds schemes

- Conclusion

The best mutual fund to invest is available in a variety. Mutual funds investments are being offered to meet the simple financial purpose of the investors. NAV explains the price of each fund per unit. The expense ratio will indicate how much amount of money one loses to charge every year.

Here is the list of best mutual funds to invest in 2019.

Pick up the fund from the list of mutual funds that you think is most investment reliable for a regular investor. These funds have been chosen in a perfectly fair way taking into account several factors. Both the qualitative measures and quantitative assessments. Sebi regulates the working of all mutual funds all over India.

Must read: How to invest in mutual funds

The best way to investment -Mutual Funds

Lets us look at all the types of best mutual funds to invest in. Also, existing with the bright platform in 2019.

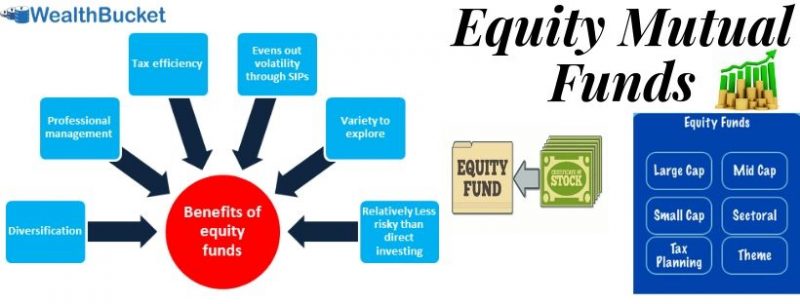

Equity Mutual Funds

Equity mutual funds are an investment in stocks. Another name for equity funds is stock funds. It can be actively or calmly (index fund) operated. Stock mutual funds are generally classified according to company size and the style of the investment holdings in the portfolio. Equity funds aim to produce great returns by investing in the shares of companies of various market capitalization. The company performance results in profit or loss determined by how much an investor can invest based on their shareholdings. There are several best equity mutual funds mentioned below.

Equity Mutual Funds

Top 10 best equity mutual funds schemes to invest in

| Name of Equity Funds (EF) | 3 year | 5 year |

|---|---|---|

| Kotak Emerging EF | 16.69% | 23.55% |

| Axis Long Term EF | 14.58% | 18.26% |

| Aditya Birla Sun Life Tax Relief 96 Fund | 14.78% | 18.36% |

| Mirae Asset Emerging Bluechip Fund | 21.96% | 26.23% |

| SBI Small Cap Fund | 17.54% | 27.30% |

| ICICI Prudential Bluechip Fund Growth | 11.44% | 14.24% |

| L&T India Value Growth | 10.44% | 21.65% |

| Canara Robeco Emerging EF | 14.19% | 19.83% |

| Reliance Small Cap Fund | 15.94% | 23.57% |

| IIFL Focused EF | 13.58 | – |

You may also like to know about: Aditya Birla mutual fund

Small-Cap Mutual funds (Equity)

- Small-cap is a word used to arrange companies with comparatively SMC (small market capitalization). A company’s market capitalization is the market price of its outstanding shares. It’s a type of equity mutual funds which invests a maximum number of its assets in the stocks of small-cap companies(SCC). These companies rank -251st and higher in names of market capitalization. Almost 95% of all Indian registered companies are SCC.

Small-cap funds are fit for those investors who are ready to take a moderately higher amount of risk for likely great returns.

Small-cap Mutual Funds

Top 10 Best Small Cap mutual funds schemes to invest in

| Name of Small Cap Mutual funds (SCF) | 3 year | 5 year |

|---|---|---|

| SBI Mutual fund SCF-Reg-Growth (G) | 14.58% | 30.60% |

| Aditya Birla SL SCF (G) | 9.75% | 20.47% |

| HDFC SCF-Reg(G) | 16.06% | 20.64% |

| Reliance SCF (G) | 12.84% | 28.25% |

| Franklin India Smaller Companies Fund (SCC) | 4.20% | 10.14% |

| DSP BlackRock SCF | 6.2% | 19.4% |

| Kotak SCF | 7.3% | 15.4% |

| Sundaram SCF | 3.9% | 14% |

| L&T Emerging Businesses Fund | 15.5% | 18% |

| HSBC Small Cap Equity Fund Growth | 16.72% | 87.87 |

Must read : HDFCMF: A Guide for Investing in HDFC Mutual Funds

Large -Cap mutual funds

Large-cap equity funds are a type of mutual fund that invests a greater proportion of their corpus in companies with high- grade market capitalization.

These funds are light in terms of risk. Large-cap are a parkway for those who require to take benefit of equity investments but do not require their returns to shift more than the market. The aim is to continue investing when the market is falling to revoke the result of the loss. To adopt a long-term view, staying patient, and continue invested to obtain great returns over the long term.

Large-cap equity mutual funds

10 best Large-Cap mutual funds schemes to invest in

| Name of Large Cap Mutual funds (LCF) | 3 year | 5 year |

|---|---|---|

| TATA LCF | 10.4% | 10.4% |

| JM LCF | 8.4% | 9.4% |

| BNP Paribas LCF | 9% | 12.2% |

| Reliance LCF | 14.9% | 14.4% |

| Union LCF | – | – |

| Essel LCF | 10.59% | – |

| LIC MF LCF | 9.38% | 10.25% |

| HSBC LCF | 11.55% | 9.60% |

| DHFL Pramerica LCF | 9.90% | 11.02% |

| IDFC LCF | 11.07% | 8.18% |

Multi-cap mutual funds

Multi-cap is fund category that reaches out among the multitude due to its significant versatility. In other words, multi-cap funds are increased equity funds that invest in stocks of companies with various market capitalizations. The investments are done in fluctuating proportions to match the investment objective of the fund.

Multi-Cap Mutual Funds invest in companies belongs to diverse market capitalization. Rather of holding to a distinct capitalization, these funds include large-cap, mid-cap and small-cap stocks in the portfolio in a particular proportion. As contrasted to complete large-cap/small-cap funds. These funds are less risky and favorite among investors.

Multi-cap mutual funds

10 best Multi-Cap mutual funds schemes to invest in

| Name of Multi-Cap Mutual funds (MCF) | 3 year | 5 year |

|---|---|---|

| Motilal Oswal Multicap 35 Fund MCF | 12.66% | 14.15% |

| Taurus Starshare MCF | 8.33% | 8.08% |

| HSBC MCF | 8.49% | 10.64% |

| DHFL Pramerica Diversified Equity Fund MCF | 10.13% | – |

| Invesco India MCF | 8.41% | 14.13% |

| Tata MCF | – | – |

| Parag Parikh Long Term Equity Fund MCF | 12.59% | 14.09% |

| Principal MCF | 13.54% | 13.36% |

| Union MCF | 9.09% | 7.57% |

| UTI Mutual funds- MCF | 10.38% | 12.17% |

Debt Mutual Funds

Debt mutual funds invest the majority of their corpus in fixed-interest or fixed-income creating opportunities and instruments. Examples of the debt funds are :

- money market instruments

- corporate bonds

- treasury bills

- government securities

- commercial papers

There are many more of debt mutual funds. They may invest in short-term or long-term bonds. The products can be securitized, money market instruments or drifting rate debt. The expense ratios on debt funds are normally lower. On average than equity funds due to all over management prices are less. Debt funds invest in various securities, based on their credit ratings. A security’s credit evaluation implies whether the issuer will default in paying the returns they guaranteed.

Debt Mutual Funds

Best 10 Debit mutual funds schemes to invest in

| Name of Debt Mutual Funds | 3 year | 5 year |

|---|---|---|

| HDFC Gilt Fund | 5.4% | 8.27% |

| DHFL Pramerica Credit Risk Fund. | 5.1% | 8.25% |

| Kotak Banking and PSU Debt fund | 6.7% | 8.27% |

| IDFC G Sec Fund – Invest Plan | 7.74% | 8.93% |

| L&T Low Duration Fund Growth | 9.38% | 8.78% |

| DSP Credit Risk Fund Regular | 6.18% | 7.81% |

| Axis Banking & PSU Debt Fund | 7.88 % | 8.23% |

| Aditya BSL Savings Fund | 7.96 % | 8.50% |

| Franklin India Short Term Income Plan (Retail) | 7.91% | 8.96% |

| ICICI Prudential Liquid Fund | 7.22% | 7.91% |

Liquid Mutual funds

Liquid Mutual Funds are debt mutual funds. That invest investors money in very short-term market instruments and financial instruments. The instruments are :

- Bank fixed deposits

- Treasury Bills

- Government securities

- Commercial Paper

- Certificate of Deposits

Call money holds the least amount of risk. Up to maturity of 91 days, these funds can invest in instruments. The maturity is usually very less than that. Liquid funds have no limits of a lock-in period. NAV is determined for business days only. They have a fair interest in risk associated with all the class of debt funds. This is the reason for actually investing in fixed income securities with a short maturity. Plus, they do not have any exit or entry load.

Liquid Mutual funds

Out of the many- best 10 Liquid mutual funds schemes

| Name of Liquid Mutual Funds | 3 year | 5 year |

|---|---|---|

| Baroda LF | 23.08% | 45.09% |

| Aditya Birla Sun Life LF | 22.95% | 44.94% |

| Tata LF | 22.97% | 44.83% |

| Axis LF Growth | 23.07% | 44.96% |

| Indiabulls LF | 23.03% | 45.18% |

| L&T LF | 22.96% | 44.83% |

| Reliance LF | 23.02% | 44.91% |

| UTI LF- Cash Plan | 23.03% | 44.75% |

| BOI AXA LF | 22.95% | 44.65% |

| ICICI Prudential LF | 22.88% | 44.47% |

Balanced mutual funds

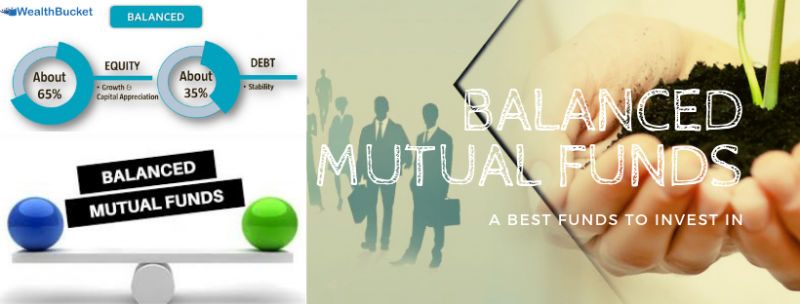

Balanced mutual funds (BF) are A balanced fund is a different option for intermediate-term investors. They are often known as hybrid funds. That own both bonds and Stock. They earn the stable moniker by maintaining the balance among the 2 asset classes moderately steady, normally putting about 60% of their assets in stocks and 40% in bonds.

Balanced funds are mutual funds that spend money over asset classes, bonds, other securities and a mix of low- to medium-risk stocks. They invest in both income and capital up-gradation.BF works retired or conventional investors exploring growth that outpaces inflation and income that enhances prevailing demands.

Balanced mutual funds

Out of the various funds best 10 Balance mutual funds schemes

| Name of Balanced Mutual Funds (BF) | 3 year | 5 year |

|---|---|---|

| HDFC BF | 10.40% | 16.07% |

| DSP BlackRock Equity and Bond Fund Growth | 10.1% | 13.1% |

| L&T Hybrid Equity Fund (HEF) | 8.76% | 15.79% |

| Edelweiss Arbitrage Fund (AF) | 6.2% | – |

| ICICI Prudential Equity & Debt Fund (EDF) | 11.22% | 15.83% |

| Reliance AF | 6.4% | 6.9% |

| SBI HEF | 9.28% | 14.98% |

| Kotak Equity AF | 6.3% | 6.8% |

| Sundaram Multi-Asset Fund | 8.8% | 7.6% |

| SBI Multi-Asset Allocation Fund | 5.5% | 8.3% |

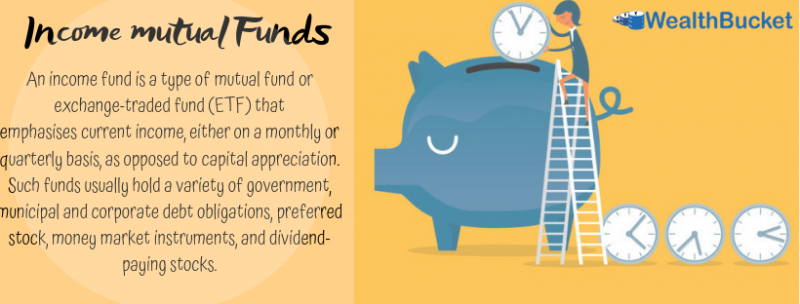

Income Mutual funds

Income funds are debt mutual funds that give a regular income. They present with a big opportunity for the investors who want to earn income in the instant. The advantage of the diversification of funds is an extra benefit as it provides for investment in equities and bonds the same. By investing in multiple asset classes like government securities, CD (certificates of deposits), and bonds. It prioritizes assets with greater interest rates. This produces a great dividend that is both invested or allocated to the investors.

Income mutual funds

From of the various funds best 10 Liquid mutual funds schemes

| Name of Income Mutual Funds | 3 year | 5 year |

|---|---|---|

| BNB Paribas Corporate Bond Fund | 8.16 % | 8.16% |

| BNB Paribas Flexi Debt Fund | 8.30% | 8.22% |

| ICICI Prudential Advisor Series – Dynamic Accrual Plan | 8.64% | 8.93% |

| HDFC Medium Term Opportunities Fund | 8.35% | 8.50% |

| Kotak Corporate Bond Fund – Standard Plan | 8.27% | 8.19% |

| ICICI Prudential Banking & PSU Debt Fund | 8.54% | 8.79% |

| Aditya Birla Sun Life Treasury Optimizer Fund | 9.16% | 9.40% |

| Axis Regular Savings Fund (SF) | 8.49% | 8.70% |

| Franklin India Income Builder Fund | 8.52% | 8.79% |

| SBI Regular SF | 9.25% | 9.57% |

Short Term Mutual Funds

Short Term Mutual Funds are mutual fund schemes that give a maturity from a least of 15 to 91 days or below that are short term mutual funds.

Maturity period depends on the assets. This investment choice is fully filled for people inquiring asset benefits with moderate risk. For investors on the view for any of the vigorous short term mutual funds (15 days or less) accessible, the liquid fund choice is a great fund to invest in. Others viewing at a maturity period of 2 to 4 months can pick from the ultra-short-term funds accessible. The tax treatment for a majority option mutual fund is the equivalent as that of a bank FD( Fixed Deposits).

Short- term mutual funds

From several funds-best 10 Short-term mutual funds schemes

| Name of Short Term Mutual Funds | 3 year | 5 year |

|---|---|---|

| DHFL Pramerica Short Maturity Fund | 6.49% | 7.59% |

| Principal Short Term Debt Fund | 6.86% | 7.72% |

| Canara Robeco Short Duration Fund | 7.23% | 6.98% |

| IDFC Bond Fund – Short Term | 7.06% | 7.78% |

| Tata Short Term Bond Fund-Regular Plan | 4.65% | 6.39% |

| Invesco India Short Term Fund | 6.72% | 7.25% |

| Baroda Short Term Bond Fund | 7.91% | 8.34% |

| HDFC Short Term Debt Fund | 7.49% | 8.18% |

| DSP Short Term Fund-Direct Plan | 7.52% | 8.43% |

| BOI AXA Short Term Income Fund | 6.56% | 7.57% |

Conclusion

Funds mentioned above are those that are constantly best year performers in their categories. Different time and evaluation measures apply for debt and equity funds. But, they all have fulfilled higher risk-adjusted rolling returns.

WealthBucket offers an exclusive variety of services linked to the mutual funds’ Liquid mutual fund, Large Cap mutual fund, Income mutual funds, Short term Mutual Funds or Multi-Cap mutual fund. One can call us at +91 9999379929. Or email your doubts at contact@wealthbucket.in.

Related Articles