Contents

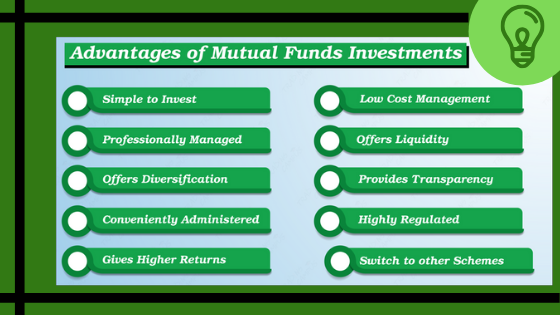

- Advantages of mutual funds

- Professional Management

- Tax Capability and efficiencies

- Numerous Choices are Open

- SIP or one-time investment option

- Built-In Diversification & Liquidity

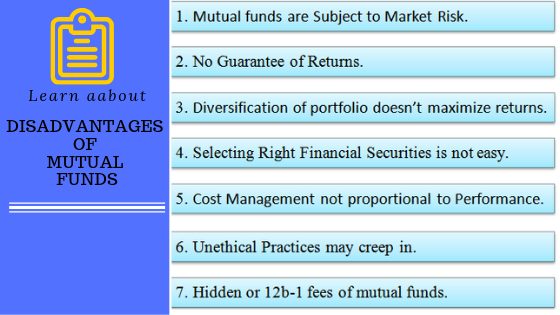

- Disadvantages of mutual funds

- No Handle Over Portfolio

- Regulate the cost in mutual funds

- Level of diversification is higher

- Locked in period

- Fees and expenses

- Conclusion

If you are thinking to invest in mutual funds one should know the advantages and disadvantages of mutual funds investment. So that further it could make your decision simple and you get to know where to invest in. To protects and secure the interest of investors Sebi along with AMFI. They attempt to improve and control standards in all areas, to guard and promote the interests of Mutual Funds and investors.

The mutual funds also provide investors with fund managers who guide them all about the mutual funds. Also, will tell you all about kinds of mutual funds that are liquid funds, debt funds, equity funds and income mutual funds and many more are there. Even we are provided with a different kind of calculators that are available online to calculate individual investments like mutual funds calculator, SIP Calculator, Lum sum calculator etc.

Meaning of mutual funds

Mutual funds mean a simple way of collecting money from many investors and pooling that money into securities.

Read More about: Mutual Funds Overview

Investing in mutual funds have various advantages. That will make an investor feel and believe that he/she is no way wrong investing in mutual funds. It will definitely provide higher benefits. Also, a coin has two faces the same as the mutual funds. If it has an advantage it will also have disadvantages. But that disadvantages can be eliminated only if investor and fund manager invest the money in the right schemes and plans.

Whether you are a seasoned or first-time investor, a mutual fund is something one must sincerely view computing to an investment portfolio. Though, one should be informed of the services as well as feasible deadfalls of this investment accessory.

Advantages of mutual funds

Professional Management

Mutual funds do not need a big deal of time or information from the investor as they are guided and managed by professional fund managers. The fund managers know all the policies, plans and terms and condition of every fund. This can be assisted by a new investor who is watching to maximize their financial goals and portfolios.

Tax Capability and efficiencies

Mutual funds are almost extra tax-efficient than other kinds of investments. On equity mutual funds long-term capital gain tax is nothing. That means, if one sell or trade their investment in 1 year after buying, one doesn’t have to pay any tax.

For debt funds, long-term capital gains practice when one keep them for 3 years. Aside from this, there are several classes of funds called ELSS funds. That is privileged under section 80C. In best ELSS funds pick up on a base of their Perpetual Performance Record.

Must read: Tax saving on mutual funds

Numerous Choices are Open

For each stage of your life, mutual funds hold a plan ready. Investors choices change as they begin another aspect of life. These funds provide to one’s requirements in a highly profitable way.

one can address their lifestyle with a financial advisor. They can lead and guide to determine the safest option.

SIP or one-time investment option

One can plan their mutual fund investment according to accounts and satisfaction. For example, beginning a SIP on a monthly or quarterly basis satisfies investors with less money. On the opposite side, if one has a surplus amount, choice for a one-time lump sum investment.

Read more about: Sip investment

Built-In Diversification & Liquidity

Mutual funds have their individual share of risks as their reviews are based on the market movement. So, the fund manager always invests in higher than 1 asset class -equities, debts, money market instruments etc. To reach and spread the risks factors plus levels. It is called diversification. This means, when 1 asset class doesn’t perform, the other can recompense with greater returns to evade the loss for investors.

Unless one choice for close-ended mutual funds, it is comparatively simpler to purchase and exit a scheme. One can sell their units at any point. Especially when the market is high. Must retain an eye on exit load or pre-exit penalty. Identify, mutual fund transactions appear only once a day after the fund house clears that day’s NAV all way.

Disadvantages of mutual funds

No Handle Over Portfolio

If one invest in a fund provides up all control of one’s portfolio to the mutual fund money managers who run it.

Regulate the cost in mutual funds

The salary of the market examiners and fund manager essentially comes from the investors. Total fund management cost is one of the foremost parameters to think when picking a mutual fund. Higher management charges do not ensure sufficient fund performance.

Level of diversification is higher

Yes, there are several advantages of diversification. There are deadfalls of being over-diversified. An estimate of it like a sliding scale: The extra securities one hold, the lower possible one are to observe their individual returns on the overall portfolio.

What this signifies is that even the risk will be decreased, then too will the potential for profits. This might be a known trade-off with diversification. But too much diversification can retract the idea one want market exposure in the initial position.

Locked in period

There are 2 separate mutual fund structures – 1 enables the investor to go in and out at any time.

Another one locks in for 5-7 years.

With this one, if one attempt to take one’s money out earlier, They will be charged for it. One must take financial advice from the advisors in which type of funds you are investing in.

Fees and expenses

Any mutual funds may charge a sales charge on all purchases that are load. This is what it costs to get into the fund. Plus, every mutual fund imposes annual expenses that are conveniently represented as an annual expense ratio. This is essentially the cost of doing business.

The expense ratio is shown as a rate and is what one pay annually as a part of their account value. The average for regulated funds is about 1.5%

Conclusion

All of the above-mentioned advantages and disadvantages will help an investor to analyse how to invest in mutual funds.

Many investors want to broaden their holdings in line to limit their vulnerability to risk. Though, most single investors cannot provide the fees and charges required to take big places in a number of individual securities. Renders to mutual funds

There are a number of profits to mutual funds, though it is vital to examine the downsides. As well as one own requirement, purposes, and risk comfort. To learn whether mutual fund investment is right for you. The above points have definitely cleared one’s all doubts.

Happily, they can take advantage of mutual funds with our website with the best investment options plans. Sign in to our website WealthBucket.

Welcome, to all the advantages of our services like Large Cap mutual fund, Multi-Cap mutual fund, Balanced Mutual Funds, Short Term Mutual Funds, EMI calculator and many more are available.

Give us a call us at +91 9999379929 for more details of the mutual fund investment. One can also email us at contact@wealthbucket.in

Related Articles

The process of investing in mutual funds