Contents

- Introduction to SIP Investment

- How does SIP investment work?

- Power of Compounding

- Rupee-Cost Averaging

- Benefits of SIP investment

- Is SIP investment Better than a Lump sum?

- Points to keep in mind while investing in SIP

- The first point is to keep Financial objective in your mind

- Value the financial objectives you have set

- Determine the objective time duration of the investment

- Pick up your assets wisely.

- Select the best scheme for SIP.

- 10 Best Performing SIP Plans

- Conclusion

Introduction to SIP Investment

Sip investment is a Systematic Investment Plan. An investment offered by mutual funds investment for investors. Enabling them to invest small fixed amounts weekly or monthly. Instead, of one-time investment.

SIP investment assures about the creation of wealth in future. Being flexible in investments the amount is automatically debited from one’s bank account. That money is invested in mutual fund schemes. Along with every instalment that person makes and the added units of schemes come into the power at current NAV. That is further added on to a person’s account.He/she receives a profit in power of compounding and Rupee Cost Averaging.

A SIP implements on a disciplined path towards investing. It imbues consistent saving modes.

Read About: SIP vs mutual funds

Note: For Short Term Mutual Funds login to the website of WealthBucket.It will provide hassle-free services.

How does SIP investment work?

SIP investment is a relaxed and effortless investment option. The money of a person is auto-debit from their bank account. That is further, invested in a particular mutual fund. A person allocates with a specific number of units based on the continuing market rate.

All the time people spend money, extra units of the scheme bring at the market rate and added to one’s account. So, the units obtain are at distinct rates. The investors receive profits from the Power of Compounding and Rupee-Cost Averaging.

Read more about: How to invest in SIP

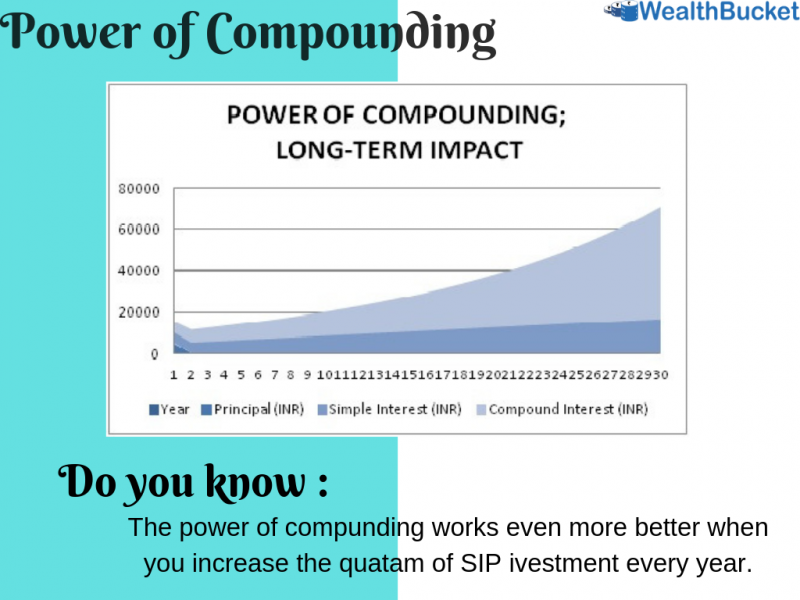

Power of Compounding

SIP investments are created in such a way that they control the power of compounding. As an investor will get profits when the value of any unit of investment at a high level. When one makes the investment for a great period of time.

The profit of compounding benefits investors to build investment. This happens especially in SIP investments as the money generated ( Capital gains ) is reinvested. This is done to generate extra returns.

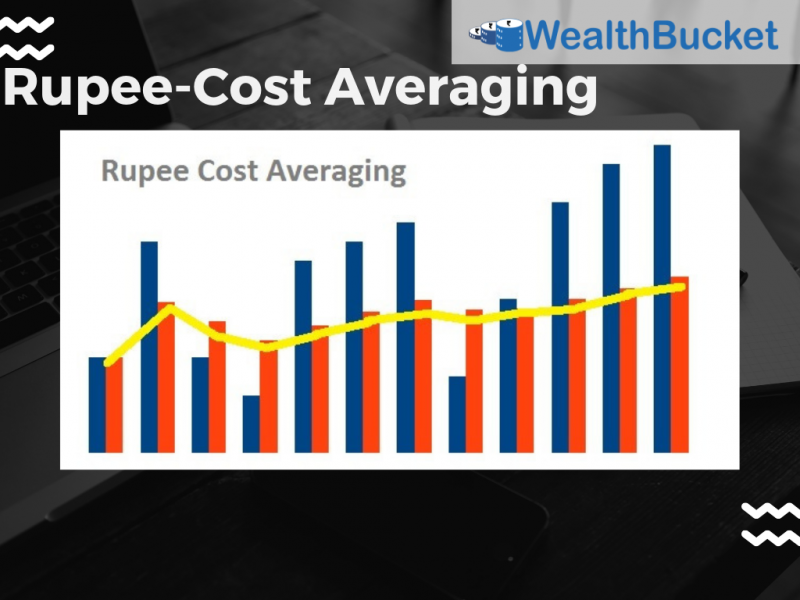

Rupee-Cost Averaging

The idea of rupee cost averaging lies in equating out the price at which investors purchase units of a mutual fund/SIP. The investment markets have continually been active, following the wax and wane of the economy. In SIP investment with active markets, maximum investors continue to be doubtful regarding the perfect time to invest. Rupee-cost averaging enables investors to opt out the best.

Being a regular investor the money retrieves extra units. When the cost is moderate and minor the price is above. While in the active period, it may allow the investor to gain an economical average cost per unit.

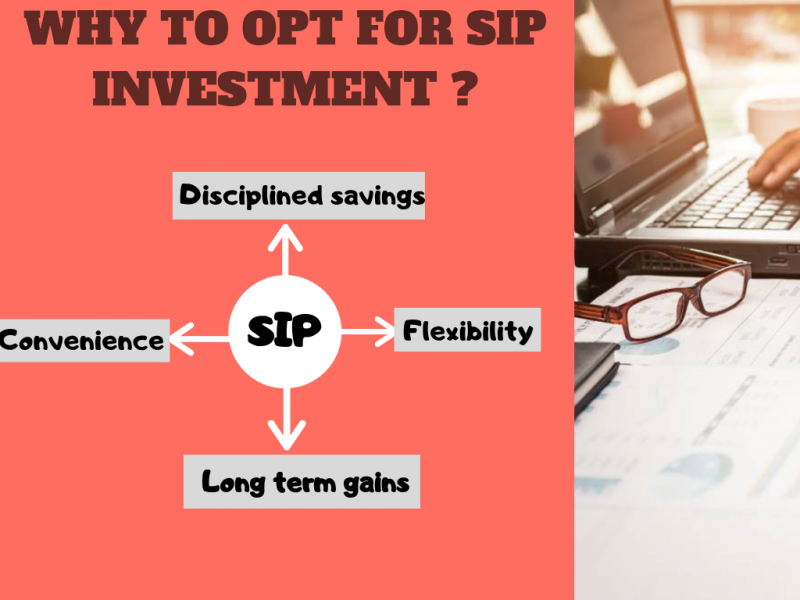

Benefits of SIP investment

- A great level of security SIP Investment can provide. Also, no burden on the investor as they are allowed to invest a fixed amount in the SIP plan.

- SIP Investment in mutual funds is the most effective and efficient key for reaching one financial goal.

- The most beneficial feature for investing in SIP – Rupee Cost Averaging and Power of Compounding.

- SIP has the capacity of Long Term Gains. It serves beneficial returns over a long investment scope.

- SIPs can assist one to manage the market timings. As it focuses on saving time for mutual funds not utilizing time in marketing.

Must Read: SIP calculator: How does it work

WHY OPT FOR SIP INVESTMENT?

Must read: Best sip plans

Is SIP investment Better than a Lump sum?

Yes, SIP investment is often viewed better than a lump sum investment in a mutual fund. The feature to note is that SIPs in maximum cases from the extended course of time have proved better than lump sum investments. As these are regular investment funds of a fixed amount and frequency they have two chief profits.

SIP involves a fixed amount of investment at constant periods despite the market situation is whatsoever. Investors manage to automatically buy extra units when the market is at a low level. This directs to a lowering average cost changing to greater returns.

Lump sum investment is in which an investor has to face with the market at a specific period. Where the market valuations may or may not less. Having the choice to invest at a normal price over a passage of time proofs SIP a valid option.SIPs is the automating the plan of investing regularly. Whereby shifting the idea of choosing when to trade and proceed to invest in commencing to greater returns.

Read about: UTIITSL Services Pan Card, Mutual Fund and Others

Points to keep in mind while investing in SIP

The first point is to keep Financial objective in your mind

Before investing in the SIP think about the investing for retirement or higher education of your children. This type of objective makes your plan of investing in SIP meaningful. Please invest wisely not just thinking about the saving tax. The investing in SIP is beyond all this.

Value the financial objectives you have set

Setting them would not work. You should have a clarity of the objectives plus know about its future aspects. Set your priorities first. For example, investing in higher education of children. They will cater to studies after 5 years. One must have the amount of Rs.30-40 lakhs. You should know the inflation factor. Add the amount in your original amount for calculating after 5 years amount. Choose the fund according to your needs and requirement.

Determine the objective time duration of the investment

Decide whether the SIP plan you are investing in is for Long-Term, Short-Term and Mid-Term objective. Long-Term Investment is of 1years. Short-Term investment is for 2 years.Mid-Term investment is for 3-5 years. Determining the time span of your financial purposes assists you to pick the right set of asset classes that will assist you to make returns.

Pick up your assets wisely.

The return generates on the basis of the correct allocation of the assets. But not the fund type you select. It’s always great to have a specific diversification of asset classes in the best investment plan. This enables you to produce stable returns even in the case of market variations.

Select the best scheme for SIP.

There are various portions while picking the correct scheme for your SIP. You need to think constituents such as earlier performance of the scheme. One should know about the fund managers of the company and they have a track record of the Asset Management company you are investing with. Additionally, look up for investing in straight schemes rather of usual ones. Direct plans of mutual funds have a moderate expense ratio. Hence make extraordinary returns than the usual plan.

10 Best Performing SIP Plans

- ICICI Prudential Equity & Debt Fund

- Reliance Small Cap Fund

- Aditya Birla Sun Life Short Term Opportunities Fund

- ICICI Prudential Equity & Debt Fund

- Mirae Asset India Equity Fund

- SBI Magnum Multi-Cap Fund

- Aditya Birla Sun Life Frontline Equity Fund

- Reliance Credit Risk Fund

- Mirae Asset Emerging Bluechip

- L&T Emerging Businesses Fund

Conclusion

Plan SIP investment looking at all the pros and corns according to one’s need and requirement. Best SIP plan is one of the reliable ways to invest in mutual funds. In a SIP you invest a fixed amount which can be re-arranged in the future. Every month in an accurate time span. This regular investment can produce generous returns over a much time period.

For looking forward to mutual funds plans and scheme. Visit our website WealthBucket. Our expert team will help you invest wisely in mutual funds. Services we offer are equity fund investment, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund. You can call us at +91 9999379929. Email at contact@wealthbucket.in. queries related to SIP investment. One can calculate their SIP investments in SIP Calculator to know about their returns.

Related Articles

Best mutual funds schemes