Contents

The economy of any country depends on the infrastructure of that country. Therefore, it is always in the interest of the government to keep the infrastructure strong, to have the economy flourishing. So is the case in India. Here quite a significant part of the GDP is spent to strengthen roads/highways, railways, other modes of transport etc. Keeping these factors in mind, it makes sense to invest at least some part of our savings in infrastructure mutual funds. One such plan is the L&T Infrastructure Fund.

L&T Infrastructure Fund is one from a few construction companies that has continued to perform well over the years. Besides, it is also one of the very limited few in the category whose growth is almost visible for the next few upcoming years.

Invest in L&T infrastructure fund

L&T Infrastructure Fund

Because L&T infrastructure fund is an Infrastructure Mutual Fund, therefore, its corpus is invested in the stocks of companies which are directly or indirectly involved in the infrastructure sector or development of infrastructure in India. It generates its revenue and capital appreciation by investing in their equity and equity related instruments.

L&T infrastructure fund gets to gain from an increase in government spending in infrastructure growth. For the same reason, it has been given a 5-star rating by several analytics companies. Even in the past, it has provided a considerably higher return, outperforming the industry benchmark, NIFTY Infra Tri, by around 2-5%.

The Corpus of the Fund is invested in companies from various sectors all related to the development of infrastructure. These may be cement, real estate, energy, power, metals, etc. The companies involved in financing the development projects, such as banks and other financial institutions. Even transport is included because it contributes to infrastructure development.

| Launch Date | Sept 2007 |

| Minimum SIP Amount | Rs. 500 only |

|---|---|

| AUM | Rs. 1515 Crore |

| NAV | 15.20 |

| 1-year Annualized Return | 36.30% |

| 3-year Annualized Return | 19.39% |

| 5-year Annualized Return | 23.96% |

| Expense Ratio | 2.14% |

| Exit Load | 1% if redeemed within 1-year |

The Fund Manager

L&T infrastructure fund is currently managed by Mr. Soumendra Nath Lahiri, Funds. These are L&T India Prudence Fund, L&T Dynamic Equity Fund, and L&T Midcap Fund, to name a few.

Holdings

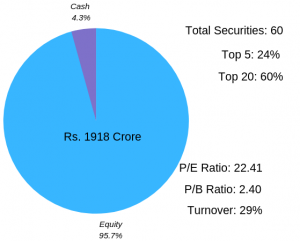

L&T infrastructure fund: Holdings: WealthBucket

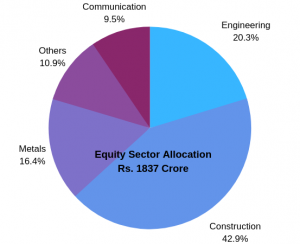

L&T infrastructure fund: Equity Allocation: WealthBucket

The holding of the corpus is approx 90% equity. The balance invested in other instruments. Though the primary focus of the fund has been all types of market cap funds. However, now the composition has switched towards large, small and mid-cap funds.

Currently, the holdings of the fund are over 23% in Large-Cap, 40% in Mid-Cap and the balance in the Small-Cap. However, the fund manager claims to maintain the balance between all this diverse portfolio.

Like all other infrastructure funds, over 25% of the corpus of L&T infrastructure fund is invested in the construction sector. Over 30% in Industrial Manufacturing, 15-17% in Cement & Cement Products. All these are related to infrastructure and development.

Other sectors have been invested are the telecom with over 13%, Energy approx 6% and Metals over 5%.

Performance & Evaluation

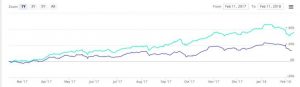

L&T Infrastructure fund has performed quite well over the short and mid-term. With its Annual Returns occurring at 37%, 20% and 24% over the past 1, 3 and 5 years respectively.

L&T infrastructure fund: Performance: WealthBucket

L&T infrastructure fund: Evaluation: WealthBucket

# All above charts and comparisons are based on data from 31st December, 2018. Visit WealthBucket for updated information.

To understand how various ratios are calculated, check Sensex Guide.

Benefits of investing in Infrastructure Funds

“Basic physical structures are essential to the operation of any country.”

⇒ India is still being counted as a developing country, and not a developed one. Implying that it is yet to grow to its full potential. For that more infrastructure needs to be developed. So this sector has the potential to grow in India.

⇒ To attract private funding for this sector, the government keeps coming up with new policies and reforms. It may even add revenue guarantees of some form or another.

⇒ Moreover, permission for 100% Foreign Direct Investment has been granted to further attract investment in this sector. Besides, India’s overall rank in ease of doing business has improved. This creates confidence in the minds of foreign investors.

⇒ Due to the improvement in various policies towards developing the construction sector for cities and townships, the government is presenting a positive outlook for growth in the infrastructure sector.

⇒ Infrastructure Funds gain from the structural growth drivers. Thereby having the ability to generate inflation-protected income.

Benefits of investing in L&T Infrastructure Funds:

- L&T Infrastructure Fund is well-diversified with a significant part of the corpus been invested in Mid Cap & Small Cap stocks. Therefore the Risk is quite minimal.

- Its risk is lower when compared to NIFTY, its benchmark.

- So far, the returns generated by L&T have been higher than the index.

Risks of investing in Infrastructure Funds

Infrastructure Funds, in general, get influenced by politics. Mostly these funds invest in projects that are long-term, running a risk of change in government and its policies, before the completion.

There may be changes in regulations, changes to taxation impacting construction and/or the removal of subsidies directly affecting the earnings of such funds.

The government is expected to tighten reforms to improve the sustainability of natural resources and implementing environment-friendly procedures.

With the implementation of RERA, (Real Estate Regulation Act), many construction projects got stalled.

Entry & Exit L&T infrastructure fund

Entry: The right time to start investing in mutual funds is NOW. Especially if you want to start with SIP, a mode of investing regularly and building your capital steadily. And let the fund manager decide on where to invest, at what time and how much. However, if you are planning to invest a lump sum, it is advisable to invest via the STP (System Transfer Plan). This enables you to transfer your investment over a specific term to reduce risks and balance returns.

Know more about investing in SIP here.

Exit: You can redeem your units as per your wishes, or when your goals have been achieved. Just remember, the exit load of 1% if you redeem before completion of 1-year. Make sure, not to exist if the market is going through a sudden low, in panic.

Taxes on Redemption: The tax on mutual funds is charged the same as that levied on the redemption of Equity Mutual Funds. If you are redeeming within 1-year, capital gains earned will attract 15% LTCG and 10% after completing 1-year. Capital gains mean you have earned an amount of over Rs. 1,00,000 on your investment.

Invest in L&T infrastructure fund with WealthBucket

With WealthBucket, you just need to get registered and start investing. It takes only a few minutes. L&T infrastructure fund is available with us. Simply choose the fund on the website and take your first step towards creating wealth.

You can also take assistance and advice from our experts for gaining through investments in equity fund investment, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund.

Call us at +91 9999379929. Or email at contact@wealthbucket.in

Read about:

What are the best Aditya birla mutual fund schemes