Contents

Short Term Mutual Fund are a good investment option if you are looking to utilize your funds during a short investment tenure. The Mutual funds plan that offers maturity from a minimum of 15-91 days, sometimes even below, are short term mutual funds. Basically, an investment period of 2 years or less qualifies for short-term investment tenure.

Such funds are best suited for times when we are in between investments. Or when we are aware that we would require funds only after a few days, weeks or months. In such situations, we usually tend to let the money stay in the savings account, earning a bare 4%. Whereas, if we invest this amount, in some short term mutual fund, we would be able to get a higher return. Investors can choose the ultra-short-term funds as well if they know they would need to redeem within a few months.

Besides availability for a short period, those investors who want to invest in schemes that have low-risk content may also opt to choose short term mutual fund.

Generally, no penalty is levied on early redemption of short term mutual fund, unless they are redeemed before a pre-determined period. This term may vary between 5-days to 6-months. On the other hand, FDs attract a penalty of up to 1% on being redeemed before its maturity date.

The Equity Mutual Funds may only earn returns over a longer investment period. Therefore, Debt-oriented and Debt funds are perfect investment options for a short duration.

For 0-6 Months of Investment Tenure

| Fund Name | Category | Risk | 1-year Annual Return | 3-year Annual Return | 5-year Annual Return | Expense Ratio |

|---|---|---|---|---|---|---|

| Axis Liquid Fund – Regular (G) | Debt (Liquid) | Low | 7.56% | 7.16% | 7.7% | 0.16% |

| Indiabulls Liquid Fund – Regular (G) | Debt (Liquid) | Low | 7.41% | 7.15% | 7.73% | 0.2% |

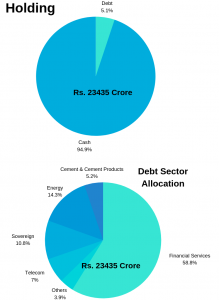

Axis Liquid Fund – Regular (Growth):

Axis Liquid Mutual Fund is one of the most popular liquid funds.

The objective is to generate good returns by keeping a lower risk profile. The liquidity of this mutual fund investment is higher. The portfolio contains a money market and high-quality debt securities.

| Launched on | October 2009 |

|---|---|

| NAV | Rs. 1953.69 |

| Plan Type | Direct |

| AUM | Rs. 24,161 Crore |

| Risk Factor | Very Low |

| Minimum SIP amount | N.A. |

| Minimum SWP amount | Rs. 1,000 |

| Performance | Has consistently outperformed its benchmark Nifty Liquid since its launch. |

| Age | 5-year old |

| Expense Ratio | 0.16% |

| Exit Load | Nil |

| Type | Open-Ended Scheme |

Short Term Mutual Funds: Axis Liquid Fund: WealthBucket

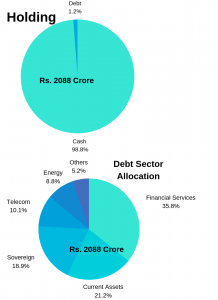

Indiabulls Liquid Fund – Regular (Growth):

As of now, Indiabulls Liquid Fund is one of the top performers amongst all the liquid funds in the market. The aim is to provide a high level of liquidity with returns that contain a low risk. The portfolio has a money market and debt securities with maturity of up to 91 days.

| Launched on | October 2011 |

|---|---|

| NAV | Rs. 1831.85 |

| Plan Type | Direct |

| AUM | Rs. 4,541 Crore |

| Risk Factor | Very Low |

| Minimum SIPamount | N.A. |

| Minimum SWP amount | Rs. 500 |

| Performance | Has consistently outperformed its benchmark CRISIL Liquid since its launch. |

| Age | 7-year old |

| Expense Ratio | 0.2% |

| Exit Load | Nil |

| Type | Open Ended Scheme |

Short Term Mutual Funds: Indiabulls Liquid Funds: WealthBucket

For 6-months to 1-year Investment Duration

| Fund Name | Category | Risk | 1-year Annual Return | 3-year Annual Return | 5-year Annual Return | Expense Ratio |

|---|---|---|---|---|---|---|

| Franklin India Ultra Short Bond Fund – IP (G) | Debt (Ultra Short Duration) | Moderate | 9.68% | 8.9% | 9.22% | 0.42% |

| Kotak Savings Fund – Regular (G) | Debt (Ultra Short Duration) | Moderate-Low | 8.1% | 7.43% | 7.94% | 0.68% |

Franklin India Ultra-Short Bond Fund – IP (Institutional Plan) – Growth:

This is a debt fund giving a return of 9.53% since its launch. The objective is to provide a combination of consistent income and high liquidity with very low risk. The funds from the portfolio are invested primarily in a mix of short-term debt and money market instruments.

| Launched on | December 2007 |

|---|---|

| NAV | Rs. 26.58 |

| Plan Type | Direct |

| AUM | Rs. 18,337 Crore |

| Risk Factor | Moderate |

| Minimum SIP Plan amount | Rs. 1,000 |

| Minimum SWP amount | Rs. 1,000 |

| Performance | Has consistently outperformed its benchmark CRISIL Liquid since its launch. |

| Age | 11-year old |

| Expense Ratio | 0.42% |

| Exit Load | Nil |

| Type | Open-Ended Scheme |

Short Term Mutual Funds: Franklin Short term Fund: WealthBucket

Kotak Savings Fund – Regular (Growth):

One of the best short term investments from the house of Kotak Mutual Fund. The investment is done significantly in floating rate securities, money market instruments by using appropriate derivatives. The purpose is to generate returns and reduce the interest rate risk.

| Launched on | August 2004 |

|---|---|

| NAV | Rs. 30.25 |

| Plan Type | Direct |

| AUM | Rs. 12,689 Crore |

| Risk Factor | Moderate |

| Minimum SIP amount | Rs. 1,000 |

| Minimum SWP amount | Rs. 1,000 |

| Performance | Has consistently outperformed its benchmark NIFTY Ultra Short Duration Debt Index since its launch. |

| Age | 14-year old |

| Expense Ratio | 0.68% |

| Exit Load | Nil |

| Type | Open Ended Scheme |

Short Term Mutual Funds: Kotak Savings Fund: WealthBucket

For 1-year to 2-years Investment Duration

| Fund Name | Category | Risk | 1-year Annual Return | 3-year Annual Return | 5-year Annual Return | Expense Ratio |

|---|---|---|---|---|---|---|

| HDFC Short Term Debt Fund | Debt (Ultra Short Duration) | Moderate-Low | 8.43% | 7.54% | 8.2% | 0.4% |

| Axis Strategic Bond Fund | Debt (Medium Duration) | Moderate-High | 8.49% | 8.35% | 9.21% | 1.05% |

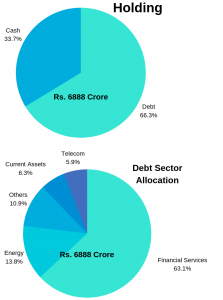

HDFC Short Term Debt Fund:

This Short term Mutual Fund, from HDFC MF, aims to generate regular income through investment in debt securities, money market, and government instruments. Provided their maturity is not beyond 30 months. It is one of the best mutual funds for this duration, currently.

| Launched on | June 2010 |

|---|---|

| NAV | Rs. 20.80 |

| Plan Type | Direct |

| AUM | Rs. 7,681 Crore |

| Risk Factor | Moderate |

| Minimum SIP amount | Rs. 500 |

| Minimum SWP amount | Rs. 1,000 |

| Performance | Has consistently outperformed its benchmark CRISIL Short-Term Bond Index since its launch. |

| Age | 8-year old |

| Expense Ratio | 0.4% |

| Exit Load | Nil |

| Type | Open-Ended Scheme |

Short Term Mutual Funds: HDFC Short Term Debt Fund: WealthBucket

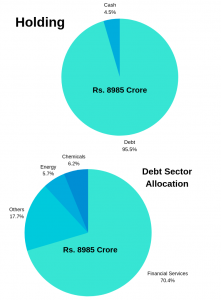

Axis Strategic Bond Fund – Growth:

This Short term Investment is an income fund. It seeks to generate maximum returns while maintaining liquidity through active management. The corpus is invested in debt instruments like corporate debentures and government securities.

| Launched on | March 2012 |

|---|---|

| NAV | Rs. 18.32 |

| Plan Type | Direct |

| AUM | Rs. 1,264 Crore |

| Risk Factor | Moderate |

| Minimum SIP amount | Rs. 1,000 |

| Minimum SWP amount | Rs. 1,000 |

| Performance | Has consistently outperformed its benchmark NIFTY Medium Duration Index since its launch. |

| Age | 7-year old |

| Expense Ratio | 1.05% |

| Exit Load | Nil |

| Type | Open-Ended Scheme |

SBI Magnum Constant Maturity Fund:

This short term mutual funds are more like gilt funds. The contents of the portfolio are securities issued by both Central and/or State, with their average maturity age being around 10-years.

While gilt funds, being backed by the government, have no risks associated with them. This fund is subject to market risks. The rates fluctuate with the changes in the interest rates. Therefore, they are not completely free from risk.

| Launched on | January 2001 |

|---|---|

| NAV | Rs. 41.07 |

| Plan Type | Direct |

| AUM | Rs. 430 Crore |

| Risk Factor | Moderate-Low |

| Minimum SIP amount | Rs. 500 |

| Minimum SWP amount | Rs. 1,000 |

| Performance | Has consistently outperformed its benchmark CRISIL 10-Year Gilt, since its launch. |

| Age | 19-year old |

| Expense Ratio | 0.64% |

| Exit Load | Nil |

| Type | Open-Ended Scheme |

Short Term Mutual Funds: SBI Magnum: WealthBucket

A few more Short Term Mutual Funds to choose for Investment in 2019

| Fund Name | Category | Risk | 1-year Annual Return | 3-year Annual Return | 5-year Annual Return | Expense Ratio |

|---|---|---|---|---|---|---|

| BOI AXA Ultra Short Duration Fund | Debt (Ultra Short Duration) | Moderate-Low | 7.96% | 8.06% | 8.4% | 0.59% |

| Indiabulls Short Term Fund – Regular (G) | Debt (Short Duration) | Low | 8.73% | 7.34% | 8.04% | 1.5% |

| Debt (Liquid) | Low | 7.59% | 7.15% | 7.69% | 0.22% |

Benefits of investing in Short Term Mutual Funds

Stable Returns: Investment in short term mutual funds usually offer a fixed rate of return with a pre-fixed maturity date. Moreover, they are not affected by the capital market fluctuations.

The portfolio is kept balanced: The risks in these short-term funds get avoided by actively allocating the portfolio in various short term assets.

Higher Returns for Short Term: Such investments offer a much better rate of return on your investments than others available in the market, such as Savings/FD, etc. Besides, they offer greater Tax Benefits as compared to other non-equity investments of the same duration.

The option of investing for Long-term: You have the option of considering these investments for long-terms as well. In fact, it would still prove to be a good investment if held for over 3-years, outperforming FDs yet again.

Early Redemption: No penalties are applied on pre-mature withdrawal for the short term mutual funds. Whereas, you may have to pay on quitting early from equity funds investment.

Risks of Investing in Short Term Mutual Funds

There is always a flip side to all good things. In a similar way, the short-term mutual funds are not completely devoid of risks. Therefore, make yourself aware of the same, so you can make a well-informed decision that will enable you to meet your financial goals.

Fluctuating Interest Rates: The fluctuations in interest rates have an impact on the prices of all the mutual funds, affecting their values. Similarly, the returns on short term mutual funds are also determined by the prevailing interest rate. The relation between the interest rates and your gains is that they are inversely proportionate to each other. A rise in the prevailing interest rates would cause a fall in your returns.

Risk of Liquidity: The flexibility to enter and exit from a short-term fund varies. Choose the one that allows you the kind of flexibility that you need. Apart from this, you must consider the changing interest rate before settling for the fund and investing.

Risk of Low Maturity Period: The lesser the maturity time of the fund, the lower will be the impact of the change in interest rate.

Inflation Risk: A higher inflation rate would adversely affect the return on your investment. The interest rates may rise, bringing down the value of your mutual fund investments.

Exposure to Credit Risk: Short term mutual funds do have credit risks. These risks get measured and a rating is awarded to them by credit rating agencies. These ratings indicate their risk exposure and quality of portfolio investment. One such agency is CRISIL, in India.

With the recent rulings by the government, for the mutual fund industry, more control over securities has been enforced. Restricting the duration between one to three years has managed to bring some volatility under control, protecting it from undue risks. Therefore, Short term mutual funds face far less interest rate risks, though some are still exposed to credit risks.

If you freshly entered the world of Mutual Funds Investments, it is advisable to take the advice of professionals with a solid experience. It is advisable to take the assistance of WealthBucket in the initial steps of your journey to wealth creation.

We have a wide variety of services on offers related to Mutual Funds. These are Liquid mutual fund, Large Cap mutual fund, Income mutual funds, or Multi-Cap mutual fund, to name just a few.

Call us at +91 9999379929. You can also email your queries at contact@wealthbucket.in.

You may also be interested in:

Best ELSS Funds to Invest in 2019

**The Returns, NAV etc. provided is as on December 31st, 2018. Please visit the website for latest information.**