Contents

- Introduction

- Offices of Sebi India

- Structure

- Functions

- Objectives

- SEBI- Authority and power

- All Regulations List

- SEBI and Mutual Funds

- SEBI Guidelines to invest in Mutual Funds

- Evaluation of your personal financial situation

- Get examined data on the mutual funds- investment schemes

- Expanding your portfolios

- Avoid the confusion of portfolios

- Attach a time dimension to the investment schemes

- Conclusion

Introduction

Sebi is known to be a Securities and Exchange Board of India. The Sebi is the controller for the securities market in India. It was launched in 1922 under the SEBI Act. It is known to be a regulatory body of goverment in India.

SEBI plays an essential part in monitoring all the performers working in the Indian capital markets. It ventures to guard the interest of investors in mutual fund investment. Mutual funds investments like Equity Mutual funds, Debt Mutual Funds, Income Funds and many more. Also, points at improving the capital markets by implementing different rules and regulations.

For more details about SEBI visit the official website maintained by the goverment of India. The government purpose is to assure that the capital (money) which the public was investing was secure. Over the years this drives to a framework of trust and respect of the stock exchange and capital market.

Must Read: New SEBI Regulation for Senior Directors

Offices of Sebi India

- It has a headquarter at the Bandra Kurla Complex in Mumbai, India.

- It has regional offices in various cities of India.

- New Delhi,

- Kolkata

- Chennai

- Ahmedabad.

- Bengaluru

- Hyderabad

- Lucknow

- Shimla

- Kochi

- Jaipur

And many more areas do have Sebi offices. It has offices all over India.

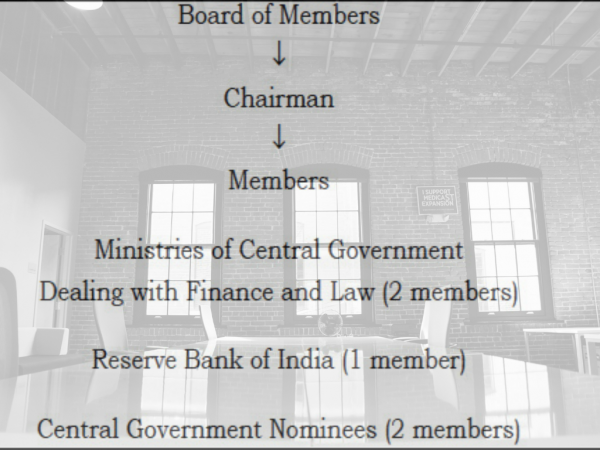

Structure

SEBI has a corporate structure including different departments all controlled by a department head. Some of the departments are as follows :

- Foreign portfolio investors

- human resources

- collective investment schemes

- commodity and derivative market regulation

- legal affairs department

And much more departments are there.

SEBI’s organisation structure comprises of 9 members:

- A chairman is chosen by the Union Government of India.

- 2 members are officers from the Union Finance Ministry.

- 1 member from the RBI.

- 5 other members who are chosen by the Union Government of India.

Functions

The Introduction of the Securities and Exchange Board of India represents the essential functions of SEBI is the security of investors interests in protection. A platform to promote, improve and monitor the securities market in India.

- Conduct research related to the securities market.

- Recording to control the functioning of workers who are linked with the securities market.

- The securities exchange board is allowed to pass rules and laws concerning to the stock exchanges.

- Administer the laws for stock exchanges to follow. SEBI reviews books of accounts of financial mediators and approved stock exchanges.

- Added role of SEBI is to make individual companies to register their shares in stock exchanges plus control the listing of distributors or brokers.

Objectives

The principal objectives of SEBI are:

- Control over Brokers

- Checking the Insider Trading

- Protection to the Investors

- Regulation of Stock Exchanges

SEBI- Authority and power

The SEBI board has 3 main powers:

- Judicial- In this, SEBI can pass on the decisions concerning to the securities market. Concerning fraud and another unfair practice. This serves to assure integrity, clarity, and liability in the securities market.

- Legislative- These powers enable SEBI to compose rules and regulations to guard the interests of the investors. Some of its regulations include:

- Insider Trading Regulations

- Listing Obligation

- Disclosure Requirements

These have been formed to prevent malpractices.

- Executive- SEBI is permitted to execute its regulations and to case against violators. It is also administered to examine books of accounts. Also, other documents if it comes between any violation of the regulations.

All Regulations List

| Year of issue | SEBI Regulations |

|---|---|

| 1992 | Stock Brokers and Sub-Brokers |

| 1992 | Merchant Bankers |

| 1993 | Underwriters |

| 1993 | Registrars to an Issue and Share Transfer Agents |

| 1993 | Portfolio Managers |

| 1993 | Debenture Trustee |

| 1994 | Bankers to an Issue |

| 1996 | Mutual Funds |

| 1996 | Custodian Of Securities |

| 1998 | Buy Back Of Securities |

| 1999 | Credit Rating Agencies |

| 1999 | Collective Investment Schemes |

| 2000 | Foreign Venture Capital Investors |

| 2001 | Procedure for Board Meetings |

| 2001 | Employees’ Service |

| 2001 | Employees’ Service |

| 2002 | Issue of Sweat Equity |

| 2003 | Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market |

| 2003 | Central Database Of Market Participants |

| 2003 | Ombudsman |

| 2004 | Self Regulatory Organisations |

| 2004 | Self Regulatory Organisations |

| 2006 | Regulatory Fee on Stock Exchanges |

| 2007 | Certification of Associated Persons in the Securities Markets |

| 2008 | Issue and Listing of Securitised Debt Instruments and Security Receipts |

| 2008 | Issue and Listing of Debt Securities |

| 2008 | Intermediaries |

| 2009 | Issue of Capital and Disclosure Requirements |

| 2009 | Investor Protection and Education Fund |

| 2009 | Delisting of Equity Shares |

| 2009 | Delisting of Equity Shares- Amendment |

| 2011 | KYC- Know Your Client Registration Agency |

| 2011 | Substantial Acquisition of Shares and Takeovers |

| 2012 | Alternative Investment Funds |

| 2013 | Issue and Listing of Non-Convertible Redeemable Preference Shares |

| 2013 | Investment Advisors |

| 2014 | Share-based employee benefits |

| 2014 | Research and analysts |

| 2014 | Real Estate investment trusts |

| 2014 | Infrastructure investment trusts |

| 2014 | Foreign portfolio investors |

| 2015 | Prohibition of insider trading |

| 2015 | Procedure for search and seizure repeal |

| 2015 | Listing obligations and disclosures requirements |

| 2015 | Issue and listing of debt securities by municipalities |

| 2018 | Securities contracts- stock exchanges and clearing corporations |

| 2018 | Issue of capital and disclosure requirement |

| 2018 | Depositories and participants |

| 2018 | Buy-back of securities |

| 2018 | Appointment of administrator and procedure for refunding to the investors |

| 2018 | Settle proceedings |

SEBI and Mutual Funds

In accordance with Sebi guidelines, mutual funds need to register as trusts under the Trusts Act, 1882. Then a firm needs to be set up as a separate AMC (asset management company) to manage a mutual fund. The net worth of AMC needs to be Rs. 50,000,000. Mutual funds need to register with the SEBI. Also, there is the existence of a self-regulation agency for mutual funds i.e. AMFI. The UTI mutual funds are controlled by UTI Asset Management Company.

The AMFI is an Association of Mutual Funds of India. It is centred on improving the Indian Mutual Fund Industry with expert and upright qualities. AMFI strives to improve the standards in all fields with a way to guard and promote mutual funds.

While of now, a total of 43 AMC are registered with SEBI and are members of AMFI.

Read more about: Mutual funds calculator

SEBI Guidelines to invest in Mutual Funds

SEBI holds in position the administrative structure. The guidelines that direct and control the financial markets in the country. The guidelines for investors are enumerated below.

Evaluation of your personal financial situation

Mutual funds offer several diversified forms of investment choices. Hence it also carries out a specific measure of a risk factor. Investors need to be quite open in their evaluation of their financial position. The risk-bearing position in the case of the poor administration of such schemes. Investors need to recognise their risk appetite along with the best investment plans.

Must read: Types of mutual funds in India

Get examined data on the mutual funds- investment schemes

Before investing in mutual fund investment, it is important for an investor to acquire accurate knowledge of the benefit of the mutual fund and its schemes. Holding valid data will make a good investment decision. This helps in picking up the best schemes, grasping the guidelines and follow. The guidelines will also keep investors notified of the investors’ rights.

Expanding your portfolios

Expanding of portfolios enables investors to reach out their investments across multiple schemes. Through enhancing prospects of boosting profits or diminish the risk of possibly immense losses. Expanding is vital to succeeding a long-term. Also, it has continuous financial support.

Avoid the confusion of portfolios

Determining the best portfolio of funds needs handling and controlling these schemes alone with concern. The investor need not confusion the portfolio and choose on the valid number of schemes. To hold so as to avoid extension and be ready to handle every one of them fairly well.

Attach a time dimension to the investment schemes

It is advisable for the investors to allocate a time frame to all scheme to support the financial maturity of the plan. It assists in including the volatility and variations in the market. Only if the programs are sustained stably across a time period.

Learn about: How to invest in mutual funds

Conclusion

The Securities and Exchange Board is the indicated regulative body for finance and markets in India. The main purpose of the board is to guard the interests of the investors in protection. Also, develop and control the securities market. SEBI has guidelines for investors to become informed of the functioning of mutual funds and sip investments. By giving the basic knowledge. They help to explain the wide spectrum of mutual fund schemes. They may seem to be quite complex to the investors.

The guidelines of mutual fund schemes are circulated by SEBI. It aims at clarifying the method of balancing several mutual fund schemes that are offered by numerous mutual fund houses.

For knowing the mutual fund schemes. Then your stop is here!

Visit our website WealthBucket is the service provider of all types of mutual funds and their schemes. The mutual funds’ services we offer are Balanced Mutual Funds, Liquid Mutual Funds, Large Cap Mutual fund or Multi-Cap Mutual fund, Short Term Mutual Funds and many more.

Call now at +91 9999379929. You can mail for any questing linking to mutual funds at contact@wealthbucket.in.

Related Articles

Best ELSS Funds to Invest in 2019