Contents

- Best SIP Plans to achieve High Growth in 2019

- Best SIP Plans in Detail

- 1. Mirae Asset India Equity Fund (Direct)

- 2. Mirae Asset Emerging Bluechip Fund – Direct – Growth

- 3. HDFC Small Cap Fund – Direct – Growth

- 4. L&T Emerging Businesses Fund – Direct – Growth

- 5. Axis Midcap Fund – Direct – Growth

- 6. L&T Midcap Fund

- 7. Aditya Birla Sun Life Equity Fund-Direct

- 8. Axis Bluechip Fund

- More of the Best SIP plans available

- What are SIPs?

- Benefits of SIPs

- Just Remember for taking the Best SIP Plans

The most preferred way to save in Mutual Funds Investment and gain mutual fund benefits is by setting up a Small Investment Investment or a SIP Plan. With the help of SIP, you can start your Mutual Funds Investment portfolio by saving and investing a small amount at regular intervals. It is a planned approach that inculcates the habit of saving and creating wealth for the future. By investing in the best SIP, after a period of time, you see your investments grow exponentially.

Investing in a SIP account with any mutual fund, your account will get debited every month, with the installment amount. This amount is invested in a mutual fund as per your chosen portfolio.

**You can check SIP Calculator to quickly work out how small investments made at regular intervals yield good returns over a long period of time. Understand benefits of using SIP Calculator here.

Best SIP Plans to achieve High Growth in 2019

| Fund | Category | Risk | 1-Year | 3-Year | 5-Year | Expense Ratio | Turnover Ratio |

|---|---|---|---|---|---|---|---|

| Mirae Asset Large Cap Fund – Direct – Growth | Large Cap Equity Fund | Moderate-High | 9.55% | 18.23% | 18.98% | 0.96% | 14% |

| Mirae Asset Emerging Bluechip Fund – Direct – Growth | Large & Mid Cap Equity Fund | Moderate-High | 5.86% | 20.4% | 25.63% | 0.61% | 35% |

| HDFC Small Cap Fund – Direct – Growth | Small Cap Equity Fund | Moderate-High | -8.08% | 19.58% | 20.28% | 0.87% | 37% |

| L&T Emerging Businesses Fund – Direct – Growth | Small Cap Equity Fund | High | -14.82% | 19.18% | N.A. | 0.85% | 183% |

Best SIP Plans in Detail

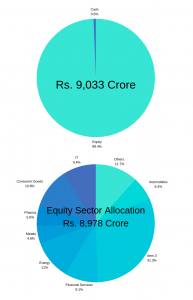

1. Mirae Asset India Equity Fund (Direct)

This is a Large Cap Mutual Fund launched on 1 January 2013 and has given a return of 19.34% since its launch. It is an open-ended Equity Mutual Funds scheme that predominantly invests across large-cap stocks. It is a fund with a moderately high risk.

This Equity Mutual Funds Scheme is suitable for Investors who are looking for high returns and investing money for at least 3-4 years.

Take note: you should also be ready for possibility of incurring moderate losses in this investment.

Key Features are:

| AUM (Asset Under Management – fund size) | Rs. 9,033 Cr |

|---|---|

| Minimum SIP | Rs. 1,000 |

| Minimum SWP | Rs. 1,000 |

| Performance in the peer group | Consistently outperformed its benchmark S&P BSE-Sensex 200 since its launch. |

| Age of the Fund | 5-years |

| Expense Ratio | 1.32% |

| Exit Load | 1% if redeemed within the first year |

| Type | Open-Ended |

| Average Ratings | 5-Star |

The objective is to capitalize on potential investment opportunities by majorly investing in equities or equity-related securities. The way of generating long-term capital appreciation.

This mutual fund has invested in stocks of large size companies. For example, HDFC Bank, Reliance Industries, Larsen & Toubro, etc. This scheme, generally, puts the funds in the top 100 companies following a market by market capital evaluation. These are huge, strong, reputable, trustworthy, and well-established companies in the equity market.

Holding:

Holdings of Mirae Asset India Equity Fund: WealthBucket

Consider investing to attain decent returns and, if you are willing to take a moderate amount of risk.

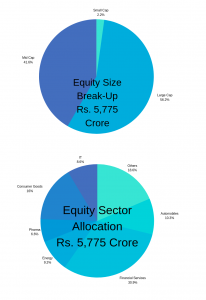

2. Mirae Asset Emerging Bluechip Fund – Direct – Growth

This scheme, too, was launched on 1 January 2013. It has invested the capital in large and midcap portfolios. This Fund has given a return of 27.47% since its launch. This a mutual fund with moderate to high risk.

| AUM (fund size) | Rs. 5,364 Cr |

|---|---|

| Minimum SIP | Rs. 1,000 |

| Minimum SWP | Rs. 1,000 |

| Performance in the peer group | Has consistently outperformed its benchmark NIFTY Large Mid cap Funds 250 Index since its launch. |

| Age of the Fund | 5-Year |

| Expense Ratio | 1.73% |

| Exit Load | 1% if redeemed within the first year |

| Type | Open-Ended |

| Average Ratings | 4-Star |

This scheme seeks to generate capital appreciation and income from a diversified portfolio, putting a large portion of the capital in Indian equities and equity-related securities of companies. These stocks are not a part of the top 100 stocks by market capitalization nor do they have a market capitalization of Rs. 100 crores at the time of investment.

This prospectus of this fund provides the fund manager with a leeway to invest up to 35% of assets in the top 100 companies by market cap, with 65% invested in mid-cap stocks. Therefore, from time to time, your fund manager may also seek participation in other Indian equity or equity-related securities to achieve maximum portfolio construction. The scheme does not guarantee or assure any returns.

Holding:

Holdings of Mirae Asset Emerging Bluechip Fund: WealthBucket

The standout feature of this fund is that it has been able to hold onto its 4-star rating without ever faltering since it made its debut.

This scheme is suitable for investors who are looking for high returns. At the same time, be ready for the possibility of taking moderate losses in your investments. You must invest money for at least 3-4 years.

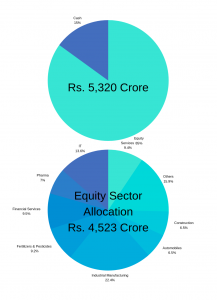

3. HDFC Small Cap Fund – Direct – Growth

This is a Small Cap Mutual Funds launched on 3 April 2008. It is a scheme with high risk and has given a return of 23.14% since its launch.

| AUM (fund size) | Rs. 5,320 Cr |

|---|---|

| Minimum SIP | Rs. 500 |

| Minimum SWP | Rs. 500 |

| Performance in the peer group | Has consistently outperformed its benchmark NIFTY Small Cap 100 TRI since its launch. |

| Age of the Fund | 5-Year |

| Expense Ratio | 0.66% |

| Exit Load | 1% if redeemed within 1-Year |

| Type | Open-Ended |

| Average Ratings | 5-Star |

The large portion of the capital is invested in the stocks of small-size companies, as the name suggests. Though such companies have highly risky stocks, it also translates into earning good returns.

The objective of this investment scheme is to generate long-term capital growth through managing the portfolio of equity and equity-related securities, including equity derivatives, actively.

Holding:

Holdings of HDFC SmallCap Fund: WealthBucket

This Mutual Fund Investment is suitable for investors who are looking for very high returns, by investing for at least 3-4 years. Just remember to be ready for the possibility of higher losses in your investments.

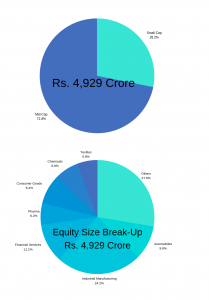

4. L&T Emerging Businesses Fund – Direct – Growth

It is a Small cap Mutual Funds Investment launched on 3 January 1997. This is a scheme with high risk and has given a return of 29.06% since its launch.

| AUM (fund size) | Rs. 5,163 Cr |

|---|---|

| Minimum SIP | Rs. 500 |

| Minimum SWP | Rs. 500 |

| Performance in the peer group | It has consistently outperformed its benchmark S&P BSE Small Cap TRI since its launch. |

| Age of the Fund | 4-Year |

| Expense Ratio | 1.57% |

| Exit Load | 1% if redeemed within 1 year |

| Type | Open-ended |

| Average Ratings | 4-Star |

This scheme invests capital in a diversified portfolio of predominantly equity and equity-related securities, including equity derivatives. Furthermore, the scheme could also invest in foreign securities, in addition to the Indian Market.

Holdings:

Holdings of L&T Emerging Business Fund: WealthBucket

It seeks to generate long-term capital appreciation.

The key theme focus is investing in start-ups and emerging companies (small-cap stocks). Such companies are businesses which are, usually, in the early stage of development and have the potential to grow their revenues and profits at a higher rate when compared with the broader market.

On the other hand, there is no assurance that the objective of the scheme will be realized and neither does the scheme guarantee any returns.

5. Axis Midcap Fund – Direct – Growth

This is considered one of the best funds in the mid-cap segment, currently:

This scheme is suitable if you are looking for high returns. You have to keep money invested for at least 3-4 years. At the same time, you should also be ready for the possibility of moderate losses in your investments.

| Launch Date | 1 January 2013 |

|---|---|

| NAV, as on 14 Sept 2018 | 39.4% |

| Plan Type | Direct |

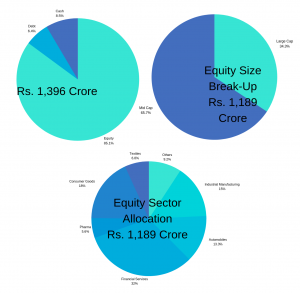

| AUM (fund size) | Rs. 1396 Cr |

| Risk factor | Moderate-High |

| Minimum SIP | Rs. 1,000 |

| Minimum SWP | Rs. 500 |

| Performance in the Peer Group | It has consistently outperformed its benchmark S&P BSE Mid Cap TRI since its launch. |

| Age of the Fund | 5-Year |

| Expense Ratio | 1.38% |

| Exit Load | 1% if redeemed within 1 year |

| Type | Open-Ended |

| Average Ratings | 5-Star |

Analysis

- In the Fund, the top 5 portfolio holdings are GRUH Finance Ltd., Bajaj Finance Ltd., Page Industries Ltd., City Union Bank Ltd., and Supreme Industries Ltd.

- The portfolio is balanced, across various sectors with the maximum portion in Mid-Cap Stocks and the least weight given to Small-Cap Stocks.

Holdings:

Holdings of Axis MidCap Fund: WealthBucket

6. L&T Midcap Fund

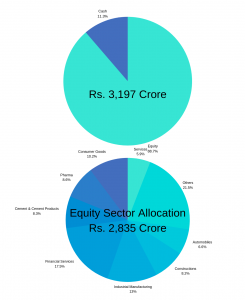

This scheme was launched on August 09, 2004. It is a mid-cap mutual fund having a high-risk factor and has given a return of 21.75% since its launch.

The fund has allocated a major portion in the mid-cap stocks. And the remaining is allocated between both the large-cap category, as well as small-cap ones.

| AUM (fund size) | Rs. 1,323 Cr |

|---|---|

| Minimum SIP | Rs. 500 |

| Performance in the peer group | It has consistently outperformed its benchmark Nifty Free Float Midcap 100 since its launch. |

| Age of the fund | 13 year old |

| Expense Ratio | 1.72% |

| Average Rating | 5-Star |

Holdings:

Holdings of L&T MidCap Fund: WealthBucket

If you are looking for a high return, this fund is suitable for you. You will need to invest money for at least 3-4 years. At the same time, you must also be ready for the possibility of incurring moderate losses on your investments.

7. Aditya Birla Sun Life Equity Fund-Direct

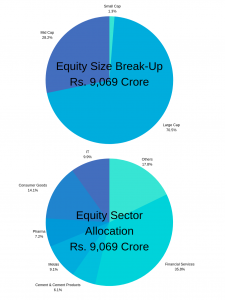

The fund seeks long-term growth of capital and regular income by investing approximately 90% of its capital in equities and the balance in debt funds and liquid funds or money market securities.

The fund manager adopts a top-down & bottom-up approach to investing. Therefore, a portion of the fund will be invested in IPOs, emerging sectors & other primary market offerings.

The scheme is appropriate if you are looking for high returns, with the time duration of at least 3-4 years. Meanwhile, you must also be ready for the possibility of incurring moderate losses on your investments.

| AUM (fund size) | Rs. 10,027 Cr |

|---|---|

| Minimum SIP | Rs. 1,000 |

| Performance within the peer group | It has consistently outperformed its benchmark S&P BSE 200 TRI since its launch. |

| Age of the fund | 25-Year |

| Expense Ratio | 1.07% |

| Average Rating | 5-Star |

Holdings:

Holdings of Aditya Birla SL Equity Fund: WealthBucket

8. Axis Bluechip Fund

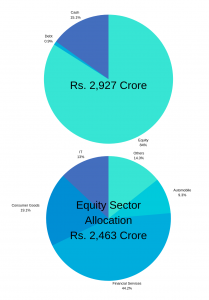

This is a Large-Cap Equity Mutual Fund Scheme, launched on 5 January 2010. It has given a return of 16.55% since its launch. This is a fund with moderately high risk.

| AUM (fund size) | Rs. 2,927 Cr |

|---|---|

| Minimum SIP | Rs. 1,000 |

| Performance within the peer group | NIFTY 50 Total Return |

| Age of the fund | 10-Year |

| Expense Ratio | 0.91% |

| Average Rating | 5-Star |

Holdings:

Holdings of Axis Bluechip Funds: WealthBucket

The objective of the fund is to generate maximum long term capital growth by investing in a diversified portfolio, which predominantly consists of equity & equity-related securities of large-cap companies. The fund has invested approximately 90% of the capital in large-cap stocks.

In case you are looking for high returns, and are ready to keep your money invested for at least 3-4 years, this is the scheme for you. Also, you must also be ready for the possibility of taking moderate losses on your investments.

More of the Best SIP plans available

| Fund | Category | Risk | 1-Year | 3-Year | 5-Year | Expense Ratio | Turnover Ratio |

|---|---|---|---|---|---|---|---|

| SBI Bluechip Fund – Direct – Growth | Large Cap (Equity) | Moderate-High | 1.46% | 12.21% | 16.53% | 1.21% | 87% |

| HDFC Mid-Cap Opportunities Fund – Direct – Growth | Mid-Cap (Equity) | Moderate-High | -8.38% | 14.02% | 19.07% | 1.22% | 58% |

| Kotak Standard Multi-Cap Fund – Direct – Growth | Multi-Cap (Equity) | Moderate-High | 8.51% | 17.6% | 19.79% | 0.97% | 13% |

| Aditya Birla Sun Life Focused Equity Fund-Direct – Growth | Focused (Equity) | Moderate-High | 5.19% | 14.01% | 15.38% | 1.13% | 47% |

| SBI Equity Hybrid Fund – Direct – Growth | Hybrid-Aggressive | Moderate-High | 6.21% | 13.06% | 15.82% | 1.32% | 259% |

What are SIPs?

SIPs have become the popular and preferred way to invest, as they tend to smoothen the anxiety related to market volatility. Under these plans, you can start investing with a small sum of Rs. 500 per month and build a solid capital.

The Mutual Funds have overtaken most other forms of investment options as they give an opportunity to novices to invest in the stock market with their desired level of risk.

- SIP is a specific amount that is invested at regular intervals continuously, for a particular pre-decided duration.

- It is similar to a recurring deposit.

- It allows you to buy units as per the frequency of SIP payment, you decide the amount and also the risk ratio of the scheme to invest in.

- Using the Principle of Cost Averaging, the number of units bought in a falling market is more than the units bought during a rising market.

- Best SIP Plans allow you to take part in the stock market, without the requirement to time it, also bringing discipline and regularity to your savings.

Different financial priorities come up at different stages of life. While you are working to meet your present financial needs, it is very important to plan for future financial requirements. It is most necessary to secure your future financial health at the onset of any unforeseen condition.

Some of the Best SIP Plans provide an additional facility of Life Insurance cover to their SIP investors. This may be known by different names, such as SIP Plus, Century SIP or SIP Ensure, etc.

Benefits of SIPs

best SIP plans: Benefits of SIP: WealthBucket

- Wealth creation: Investing regularly for a long duration helps you accumulate a sizeable fund through compounding effect.

- Achieve financial goals: Best SIP Plans provide the perfect tool for people who have a specific, future financial objective. It may be your child’s education, accumulating funds for your own start-ups, marriage or comfortable post-retirement life.

- Liquidity: What is the use of money if you can’t use it is needed, like an emergency situation? SIP is one of the most liquid forms of investment and it can save you during a financial crisis.

- Power of saving: When you start investing at an early age, and regularly, make money work with a significant impact on wealth accumulation. The longer one delays in starting to invest, the greater the financial burden to meet the desired goals. Best SIP Plans help you save and grow your money over a period of time.

- Rupee Cost Averaging: Timing the market is a difficult task, for those who are busy with their own work/profession/business. Rupee cost averaging is an automatic mechanism that eliminates the need to time one’s investments according to the market ups and lows. Here, you do not need to worry about where share prices are headed. Investment of a regular sum is done at regular intervals, so fewer units are bought in a declining market and more units in a rising market. Although SIP does not guarantee a profit, it still goes a long way in minimizing the effects of investing in volatile markets.

- Disciplined Investing: Regular and disciplined investment is the key to investing success. This leads to wealth accumulation. SIP is a time-tested discipline making it easy to invest automatically. Investing regularly, in small amounts lead to better results than investing in a lump sum.

- Convenience: To start investing, the Best SIP Plans involves only taking 3 simple paperless steps:

- Register for a SIP online,

- Fill in the details as required,

- Ensure that the funds are available in your account at the time of SIP due.

Just Remember for taking the Best SIP Plans

There are a lot of important things you should look into before selecting the Best Mutual Fund Scheme which will match your investment goals. These are the few significant points you must always remember before investing in Mutual Funds:

- Higher Returns: The option with the highest returns may not always be the one for you. Invest based on the goals you want to invest in.

- Every person’s financial conditions and objectives are different. Evaluate the Mutual Funds Benefits, by yourself. Take into consideration whether it suits your circumstances. Do not invest in a fund because of its popularity only.

- SIP is a much safer option if you want to invest in equity-oriented mutual funds.

- Direct Plans gives a higher return as compared to a Regular Plan of mutual fund schemes.

- Review your investment at regular intervals, though not too often.

- There are various myths and false beliefs surrounding mutual fund investments. You must judge which ones to believe in and what to ignore.

P.S.: In the above list, we presented the information on the Best SIP Plans in market as on 30 Sept 2018, but do consider the market fluctuations, before investing in these. Also, you need to rank the schemes taking into account, your own goals, objectives and your risk appetite.

For help and proper guidance, with investments, get yourself registered with WealthBucket. Here, you can avail services like Equity Mutual fund, Debt mutual fund, Large Cap mutual fund or Multi-Cap mutual fund.

Do call us at +91 9999379929. Or email at contact@wealthbucket.in